HDFC Bank Credit Card NetBanking : hdfcbank.com

Organisation : HDFC Bank

Service Name : Credit Card NetBanking

Country: India

Website : http://www.hdfcbank.com/personal/ways-to-bank/bank-online/credit-cards-netbanking

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

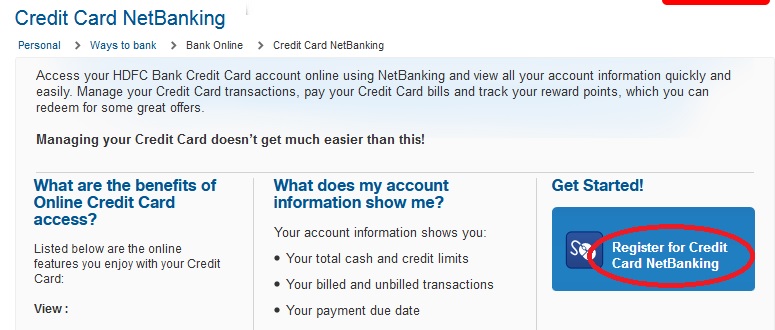

HDFC Bank Credit Card NetBanking

Access your HDFC Bank Credit Card account online using NetBanking and view all your account information quickly and easily.

Related / Similar Facility :

Credit Card Bill Payment Online

Manage your Credit Card transactions, pay your Credit Card bills and track your reward points, which you can redeem for some great offers. Managing your Credit Card doesn’t get much easier than this!

What are the benefits of Online Credit Card access?:

Listed below are the online features you enjoy with your Credit Card

View :

** Account Information

** Unbilled Transactions

** Credit Card Statements (up to last 6 months)

Request for:

** Credit Card Payments

** Autopay Registration

** Autopay De-registration

** Registration of New Card

** De-registration of Card

** Statement on E-mail

** Credit Card ATM Pin

What does my account information show me?Your account information shows you:

** Your total cash and credit limits

** Your billed and unbilled transactions

** Your payment due date

** The reward points you have earned on your card

This helps you monitor your Credit Card transactions and know when your Credit Card bills are due for payment. You can see your reward points and enjoy the benefits they offer.

How To Register For Credit Card NetBanking?

Step 1:

Register Now to get online access to your credit card. This service is free of charge. You will have complete privacy when you access your credit card NetBanking.

Step 2:

Login to NetBanking, go to your Credit Card tab and click register new card, to register your card.

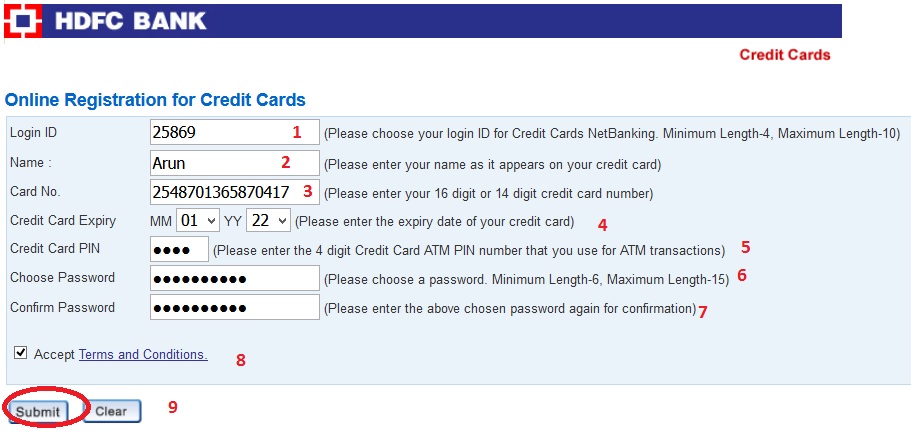

Steps :

1. Enter Your Your Login ID (Minimum Length-4, Maximum Length-10)

2. Enter Your Name

3. Enter Your Card No. (Please enter your 16 digit or 14 digit credit card number)

4. Enter Your Credit Card Expiry

5. Enter Your Credit Card PIN (Please enter the 4 digit Credit Card ATM PIN number that you use for ATM transactions)

6. Enter Your Choose Password Minimum Length-6, Maximum Length-15)

7. Re Enter Your Confirm Password

8. Tick the check box

9. Click on submit button.

Hotlist your Credit Card NetBanking:

When your credit card is lost or stolen, you can block your card and place a request to re-issue the credit card using the Hotlisting facility under the credit card NetBanking page.

On blocking the card, the credit limit on the card becomes zero and there can be no transactions made using the credit card.

FAQ On Credit Card NetBanking

Frequently Asked Questions (FAQ) On Credit Card NetBanking

How do I block the card?:

Login into your NetBanking account and choose the Hotlisting option under the credit card tab.

Choose the card to be blocked from the drop down mentioning the reason (Lost or Stolen).

Also choose if you would like to apply for the card to be re-issued (Yes or No) and submit.

Can I block the card now and opt for it to be re-issued at a later date? :

No, you cannot. You can only either choose Yes or No for re-issue. If you would want the card to be re-issued on a later date, choose No now and call the HDFC Bank Customer Service number and place a request for re-issue of card.

Will I be charged for this? :

Yes, you will be charged Rs 100 as a fee for this service.

In how many days will my card be re-issued? :

Your credit card will be re-issued within 10-15 working days.

Can I use this Hotlisting service if my card is damaged or destroyed? :

No, you will have to call the HDFC Bank Customer Service number and place a request if your card is damaged or destroyed.

Cash on Call / Dial an EMI:

Cash on Call – is a facility where you can avail Cash Loan within the eligible credit limit on your credit card

Dial an EMI – is a facility that allows you to convert your credit card purchases into EMI’s at attractive Interest rates.

What is Cash on Call?:

Cash on Call is a facility where you can avail a Cash Loan within the eligible credit limit on your credit card.

Is this facility available for all customers? :

No. This facility is available only for select customers who are eligible as per the bank policy.

How do I apply for Cash on Call facility? :

You can apply online from your NetBanking account or call up your PhoneBanking helpline number.

How do I apply online for Cash on Call?:

** Log in into your NetBanking account, click on ‘Credit Card’ tab and choose ‘Cash on Call from the options provided on the left hand side

** Choose the card and click on ‘Continue’

** Enter the required loan amount, tenure and confirm.

What are the documents required to avail this facility through the online channel? :

No documents are required. It is a completely online process.

What is the maximum loan amount offered? :

Loan amount offered is from Rs.10,000 to Rs.3,00,000, subject to available balance on the credit card.

What is the interest rate at which EMI is calculated? :

The interest rate varies depending upon the repayment tenure that you choose. Please log in to your NetBanking account for more details.

By when and how will I get the loan credited to my savings account?

The loan amount will get disbursed to your savings account within 48 hours.

Can I get the loan amount disbursed to me in the form of a DD?:

Yes. You will have to call PhoneBanking helpline and apply. If you apply Through NetBanking, the loan amount will only be disbursed through direct credit to your savings account.

Are there any fees for this facility? :

Yes, one time limited flat processing fee offer (per loan) of Rs 500 plus service tax @ 12.36%, if applied through NetBanking or 2% on the loan amount, subject to a minimum of Rs.500 and maximum of Rs 2000, plus service tax if processed through other channels.

How can I pay back my loan amount? :

Loan EMI amount gets billed to the card account on a monthly basis and part of the Minimum Amount Due which is to be paid monthly.

What is ‘Dial an EMI’?:

‘Dial an EMI’ is a facility where you can convert your purchases on your credit card into EMIs at attractive interest rates.

What is the maximum EMI tenure?:

Tenure options available are from 6 months to a maximum of 36 months. E.g., 6/12/24/36

Can I convert all my purchases into an EMI? :

No. The minimum value of purchase needs to be Rs 5000 or above to be eligible for the ‘Dial an EMI’ facility

Can I pre-close the loan within my loan tenure?:

Yes the loan can be pre-closed with a pre closing charges of 3% on the outstanding principal at the time of closer.

How do I apply online for Dial an EMI?:

** Log in into your NetBanking account, click on Credit Card tab and choose ‘Dial an EMI’ from the options provided on the left hand side

** Choose the card and click on ‘Continue’

** Select the transaction for ‘Dial an EMI’ option and confirm

Is the facility available for all customers? :

No. This facility is available only for select customers who are eligible as per the bank policy.

How do I apply for Dial an EMI facility? :

You need to apply for this online from your NetBanking account or call up your Phone Banking helpline number

Are there any fees for this facility? :

Yes, one time limited flat processing fee offer (per loan) of Rs 250 plus service tax @ 12.36%, if applied through NetBanking or 2% on the loan amount, subject to a minimum of Rs.250 and maximum of Rs 1750, plus service tax if processed through other channels.

By when will the purchases converted into EMI option? :

Your purchases will get converted with in 24 hrs post your acceptance and the same would reflect in your immediate billing cycle.

Features of HDFC Bank Credit Card NetBanking

HDFC Bank Credit Card NetBanking is a secure and convenient way to manage your credit card account online. You can access your account anytime, anywhere, and perform a variety of transactions, including:

** View your account balance and statement

** Make a payment

** Set up automatic payments

** View your credit limit

** Request a credit limit increase

** Dispute a transaction

** Report a lost or stolen card

** Enroll in reward programs

** And more

My date of birth is 01/05/1984 & application number is 17092516088560S4. I need card status.

I have applied for HDFC credit card.

My application reference number : 170816177619XXXX.

My DOB is 01/05/1972.

Application number : cc3278XXXX

Please let me know the status of card.

You need your mobile number also to track the status.

My application number is 17063011855270s2. I need my application status please.

I applied for credit card. Till now I didn’t receive it.

I have applied HDFC credit card. My application reference number is 17012012138870ND. My application form number is s CC30352536. My date of birth is 05/10/1983.

I applied HDFC credit card on November onwards. My reference number is 16110921851340TV. My application status is in process. Still now I am not getting credit card.

I have applied for HDFC credit card.

My application reference number : 16110419459870QJ

My DOB is 23/02/1977.

Application number : 16110419459870QJ

Please let me know the status of card.

I have applied for Hdfc credit card. My ref Application no is 16101819960160N1.

My dob is 26/09/1988. Please check and revert immediately.

I Have applied for HDFC credit card.

My application reference number is 16060717621560o2.

My date of birth is 03.07.1984.

Application number : cc27698226

Please let me status of card.

I have applied for HDFC credit card.

My application reference number : 16072916293520S3.

My DOB is 17/02/1989.

Application number : CC28411611

Please let me know the status of card.

What is the status of my credit card application?

I have applied credit card.

Application no.cc27304843

Ref.no : 16071518762740S1

What is the status?

I have applied for hdfc credit card.

My application reference no:16071811944790S4

My DOB IS 21/01/1985.

PLEASE LET ME KNOW THE STATUS.

I have applied for HDFC credit card.

My application reference number : 16062119237700w2.

My DOB is 25/11/1981.

The card are till date not received. Please confirm status.

I have applied for hdfc credit card.

My application reference number : 16062513716520N4

My DOB is 07/03/1983.

Application number : cc27859706

Please let me know the status of card.

I HAVE APPLIED CREDIT CARD. LET ME KNOW THE STATUS WHERE IS MY CARD WHEN IT IS RECEIVED TO ME. MY APPLICATION REFERENCE NO IS 16062215313720WC.

I have applied credit card last two weeks ago.

Please give me status for my application.

My app.ref.no.is 16070217494430V4.

I HAVE APPLIED FOR CREDIT CARD.

MY APPLICATION REFERENCE NO IS 16061514448590S1.

MY DOB IS 15/09/1962.

APPLICATION NUMBER IS CC27440153.

PLEASE LET ME KNOW THE STATUS OF CARD.

I have applied for HDFC credit card.

My application no is 16061018052170N1.

MY DOB IS 04/08/1992.

APPLICATION NO. IS CC27026242.

PLEASE LET ME KNOW THE STATUS OF CREDIT CARD.

Please let me know the status of my credit card application no. 16050919575660WC .

I have applied for hdfc credit card

My application reference number is 16032115227700pk.

My DOB is 03/09/1968.

Application number : cc26305963

Please let me know the status of card.

I have applied credit card cc26449341. When will I get card?

Application No : CC26992003

DOB : 11/07/1990

Let me know the status.

I have applied for hdfc credit card. My application ref no is 16042817448810EB. My Dob is 25/12/1990. Please let me know the status of card.

APPLICATION NO : CC26607016

REF NO : 16050912494080WC

16050216828260S3

DOB : 08/09/1980

I have applied HDFC credit cards. Please let me know the status of card

Acknowledge number is CC27153393.

Ref No.16041620392400O1

D.O.B 28/2/1989

I have applied for credit card. I want to know the status of the card

MY APPLICATION REF NO : 16040114101200

DOB : 15/06/1980

PLEASE INFORM MY APPLICATION STATUS

Please provide valid 16 digit Application Reference Number.

Enquiry about the card.

Application reference no 16030916010270O1

I have applied for hdfc credit card. My application reference no is 16031916102370BA.

My DOB: 05/11/1986

Please let me know the status.

Application Reference Number : 16031916102370BA

Status : DISAPPROVED

I have applied credit card. My reference no is 16022615814560S1. D. O. B. 11. 05. 1965. Please intimate status of my credit card.

My reference no: 1602251365807001

MY DOB: 10/11/1985

Please tell status of my credit card.

I have applied for a credit card. My reference id is.16030115162820S1

Dob: 28/06/1990

Please let me know the status.

No record found.

DOB:- 10/11/1990

MOB No :- 8376919145

Application Reference Number : 16022714927540N1

Card status?

I have applied for hdfc money back credit card with app. no:CC25367378. Please send me the status.

My reference no: 16021717785500N1

MY APPLICANT NO: CC25269323

MY BOB: 16/11/1987

Please tell status of my credit card.

Application Reference Number : 16021717785500N1

Status : IN PROCESS

Dob.04/08/1977

Application Reference Number : 16021718802220S1

Card status?

Application Reference Number : 16021718802220S1

Status : IN PROCESS

I have applied HDFC credit cards.

MY DOB 30/04/1985

Acknowledge number is CC24418319.

Please let me know the status of card .

I have applied HDFC credit cards.

Acknowledge number is CC24418319.

Please let me know the status of card .

Dob.22/12/1986

Application Reference Number : 16013018041450W3

Card Status?

Application Reference Number : 16013018041450W3

Status : DISAPPROVED

Remarks : DISAPPROVAL OF THE CREDIT CARD APPLICATION DOES NOT REFLECT IN ANYWAY ON YOUR CREDIT STANDING OR YOUR FINANCIAL STABILITY

I have applied for HDFC credit card.

My application reference number : 16021021194330s2.

My DOB is 07/09/1991.

Application number : cc25154150

Please let me know the status of card.