ETDUT e-Payment Chandigarh : Excise & Taxation

Organization : Excise & Taxation Department

Service Name : e-Payment

Applicable State/UT : Chandigarh

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

Website : http://etdut.gov.in/ExciseOnline/FAQ.htm

ETDUT e-Payment

1. What is e-payment of taxes?:

This is a facility provided to the taxpayers to make VAT/CST tax payments through internet, using net-banking facility.

Related : ETDUT E-Registration Chandigarh : www.statusin.in/8739.html

2. How can I use this facility to pay VAT/CST tax?:

You can use the facility if :

a) You have a bank account with net-banking facility, and are in possession of a unique id and password.

b) Your bank is listed amongst those providing e- payment facility to the department of Excise & Taxation Chandigarh.

3. What should I do if my bank does not have an online payment facility or is not an authorized bank for etax ?:

In such a case, the payment may be made using any other netbanking id or password belonging to a family member, friend etc.

4. What is the procedure for entering the required data on the screen for paying tax online?:

Follow the steps as under to pay tax online:

Step-1:

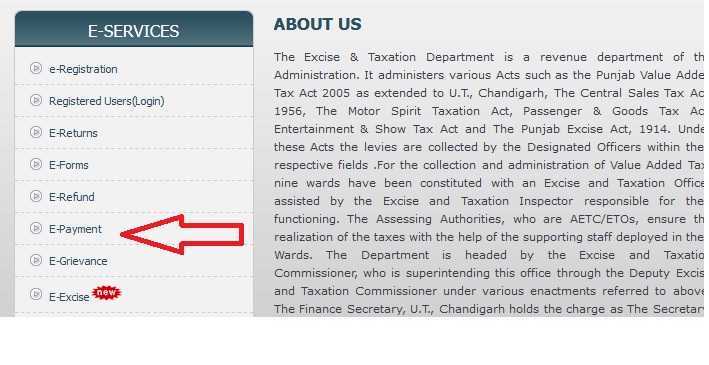

a) Log on to Excise & Taxation Department website (etdut.gov.in). using your id and password.

b) Click on the icon e-payment

c) Fill in the details of the tax to be paid.

d) You will be redirected to “PAYU” portal.

e) Make the e-payment using the netbanking id and password.

5. What is the procedure after being directed to the net banking site of the bank?:

etdut.gov.in website will direct you to “PAYU” portal where the id and password required for netbanking and issued by your bank shall be required. After you proceed to make the e-payment using netbanking, an OTP would be recieved on your mobile and payment would be made.

6. What will happen after I confirm the payment of tax at my bank’s site?:

Your bank will process the transaction and your account would be debited in favour of the Excise and Taxation Department. A printable acknowledgment in Form VAT-2 (i.e. payment challan) would appear on your screen. A unique number would be indicated on it.

7. How would i know that i have successfully compleed the tax payment:

Beides the acknowledgment receipt, you would also receive an automated message on your mobile number registered with he department. Please ensure that working mobile number is entered with the Excise & Taxation Department-Chandigarh.

8. Do I have to attach the acknowledgment counterfoil with my return?:

Yes, you have to attach the acknowledgment counterfoil of VAT-2 chllan along with your return.

9. If I encounter any problem while making payment through internet whom should I contact?:

If any problem encountered on the website etdut.gov.in, you may contact the department on email id : eto2-chd@nic.in, mkthakur84@gmail.com

10. If the account get debited more than once for the same e-tax transaction what should I do?:

In such an eventuality, please contact the department of Excise & Taxation by mailing the date of auch transactions. The needful would be done at our level after going through the details and bank M.I.S. for reversing the excess payment.

11. How does this system of payment of taxes through internet benefit me as a taxpayer?:

This system is completly transparent, error and hassle free. It would do away with the need of visiting the bank for making make the payments. Further it would be possible to track the update payments made with the department by checking the payment status on you Dashboard.