How to E-Register : CTD Tamil Nadu

Organization : Tamil Nadu Commercial Taxes Department

Service Name : How to E-Register?

Applicable State: Tamil Nadu

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

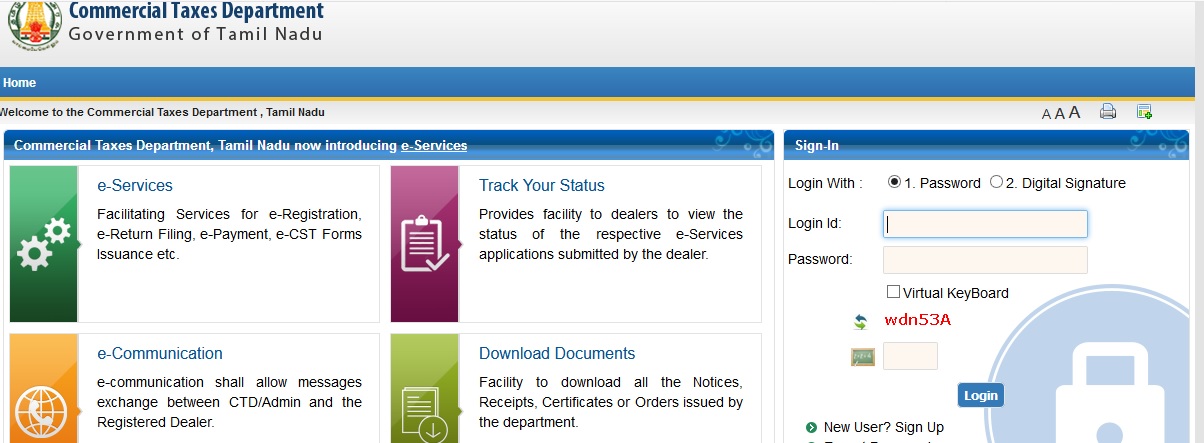

Website : https://ctd.tn.gov.in/home

eRegister: https://ctd.tn.gov.in/Portal/

User Manual : https://www.statusin.in/uploads/15841-Registration.pdf

CTD E-Registration

E-Registration is designed to enable self-Registration by the dealers. They can register themselves on the web portal. An acknowledgement receipt is generated on successful filling of the form and uploading all the required or mandatory documents.

Related : CTD Tamil Nadu E-Refund : www.statusin.in/15838.html

e-Amendment:

E-Amendment is designed to enable the amendment of any applicable details provided during registration. Only registered dealers can amend their registration details for particular tax types in which they are registered. An acknowledgement receipt is generated on successful filling of all the forms and uploading all the required or mandatory documents.

Dealer Data Correction

Dealer Data Correction is designed to allow registered dealer to correct registration data after log in into Web Portal. An acknowledgement receipt is generated on successful uploading of the forms.

e-Cancellation

E-Cancellation is designed to request self-cancelling the registration of any registered dealer. An acknowledgement receipt is generated on successful filling of all the forms and uploading all the required or mandatory documents

E-Registration of Value Added Tax:

To register with through Web Portal, first you need to sign into the system with the login credentials you received during the Sign Up process.

After sign in to the system, follow the steps listed below to do registration:

1. On the homepage, click e-Registration link and select e-Registration application. The e-Registration screen opens.

2. Select the tax type you want to register for. After selecting tax type, click Submit to proceed.

3. Click on “Click here” link to download VAT registration template. A pop-up window opens to save or open the template.

4. Click Save File to save the template or Open With to open a template in the system.

5. After filling the data in the template, click Validate Button to validate the data entered by you. If there is any error in the data, it will be displayed in Error sheet. If there is no error in the filled data it will say no error found in the work book

6. Click on Generate XML button to generate upload file. It will ask for the path to save the upload file. System will show you a message that your file is saved at the location you have provided

7. Select the generated .XML file to upload.

8. Click Submit to save the data. After the data is saved, acknowledgement number is generated. You have to attach requisite documents to finish the registration process. The next screen appears with the Acknowledgement Number.

9. Click “Click here” to move Payment page.

10. Select a Bank and click on confirm button and submit the data

11. Click on Upload Documents and select the Acknowledgement Number.

12. Select the category and sub-category (if any) of the document to be uploaded.

13. Select the document and click Upload to upload that document. After the document is uploaded it will be displayed in the table displayed below on the same page.

14. After submitting all the mandatory and required attachments, click Submit and Complete Registration Process. The acknowledgement receipt and task is generated in the back office for approval and success screen appears.

15. Click the Acknowledgement Number generated to view the acknowledgement receipt.

FAQ On Tamil Nadu Commercial Taxes

Sure, here are some frequently asked questions (FAQ) about Tamil Nadu Commercial Taxes:

What is Tamil Nadu Commercial Taxes?

Tamil Nadu Commercial Taxes is a department of the Government of Tamil Nadu that is responsible for collecting taxes on goods and services sold in the state. The department also enforces the laws related to commercial taxes.

What are the different types of taxes collected by Tamil Nadu Commercial Taxes?

Tamil Nadu Commercial Taxes collects a variety of taxes, including:

** Value Added Tax (VAT)

** Central Sales Tax (CST)

** Entertainment Tax

** Luxury Tax

** Betting Tax

** Advertisement Tax

** Entry Tax

** Stamp Duty

Who is liable to pay Tamil Nadu Commercial Taxes?

Any person who sells goods or services in Tamil Nadu is liable to pay commercial taxes. This includes individuals, businesses, and government agencies.

TIN 33816320845 \ dept posted log in ID & password but when it is applied it says that invalid log in ID& password. What is the next step to proceed to get password & ID. The same problem exists in TIN 33862323302 also. We are unable to submit online return for JUNE 16 till. Please provide a solution.

I am Varun from Nagercoil. I have registered for TIN & CST. I got the tin no. The registered dealer says now both tin & cst are have same nos. So you can use the tin no as the cst no. I am very confused. Kindly make me clear.

How to confirm for submission finally?

Sri Ganesh Colour company, Erode tin 33263040365

We successfully sign up process completely, but we can’t get new portal password. Please do necessary steps or how we can get new portal password?

Signup process completed but new portal password not received. What I can do?

WHAT ARE THE MANDATORY DOCUMENTS NEED TO BE UPLOADED AT THE TIME OF FILING NEW VAT REGISTRATION AS PER PRESENT/NEW REQUIREMENT ASKED BY THE T.N.CTD?

WHETHER IS IT MADE MANDATORY IN ANY CASE TO GIVE BANK ACCOUNT DETAILS OF ALL THE DIRECTORS?

ALSO GIVE THE LIST OF DOCUMENTS TO BE SUBMITTED FOR NEW REGISTRATION.

In the column First Name and Middle Name and last name, which name can I fill, name of the proprietor or partner of a firm or Only the name of firm or concern for registered dealers?