GHMC : Check Property Tax Dues Online Hyderabad

Organization : Greater Hyderabad Municipal Corporation Telangana (GHMC)

Facility : Check Property Tax Dues

Check tax dues here : https://onlinepayments.ghmc.gov.in/

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

What is GHMC Property Tax Dues?

You can follow the below guidelines to GHMC check Property Tax Dues.

Related / Similar Facility :

GHMC Calculation of Property Tax

How To Check GHMC Property Tax Dues?

Just follow the simple steps mentioned below to Check GHMC Property Tax Dues

Steps:

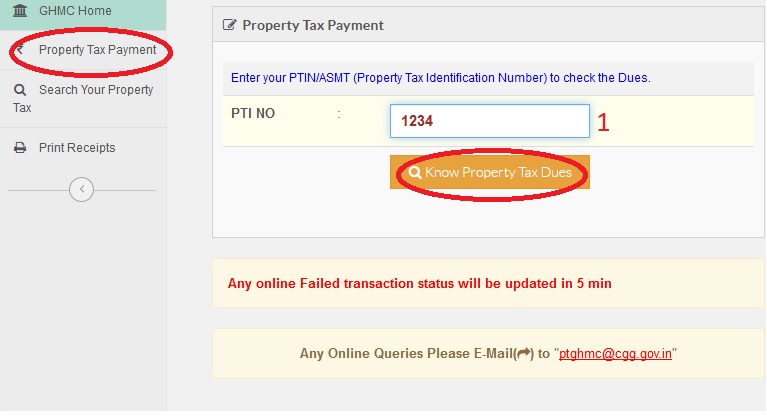

1. Go to Online Payment of Property Tax available in the GHMC home page as shown below

2.Enter your PTIN/ASMT (Property Tax Identification Number) to check the GHMC Property Tax Dues

This video is step by step guide to Check Property Tax Dues online through GHMC Portal.

** Any online Failed transaction status will be updated in 5 min

** Any Online Queries Please E-Mail() to “ptghmc [AT] cgg.gov.in”

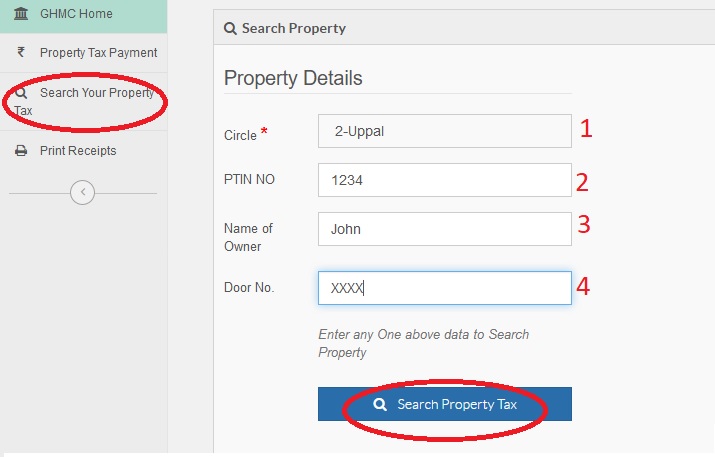

** If you do not know the PTIN/ASMT, Search for PTIN/ASMT by Owner Name , Door No and Old PTIN

Note :

** “A unique PTIN” (Property Tax Identification Number) is alloted for each Tax Assessee.

** The PTIN/ASMT is Fourteen digits for old PTINs and Ten digits for new PTINs.

PTIN No :

** PTIN is a 10 digit number

** First number is common for all circles

** 2,3 digits circle number

** 4,5 digits Revenue wards

** the last 5 digits is the serial No.

How to pay my Property tax online?

** You can pay your Property tax in any of the eSeva centers located in Hyderabad and Secunderabad.

** You can also pay your Property tax at the GHMC citizen service centres.

How do I calculate my Property Tax?

Annual Tax is calculated as 3.5 X Total plinth area (in SFt) X Monthly rental value (per SFt in Rs.)

Search Your Property Tax

Enter any One below data to Search Property

1. Select Circle *

2. Enter PTIN NO

3. Enter Name of Owner

4. Enter Door No.

5. Click Search Property Tax Button

New Assessment Of Property Tax

1. The applicant should submit the application with relevant documents to the concerned Deputy Commissioners / CSC

2. The concerned tax inspector/ VO/AMC/TI to inspect the building physically and also verify whether it is having clear title or any litigation such as government land, wakf land, ULC land or any court dispute etc.,

3. Then assess the property tax as per prevailing rates of residential and as per Area Based Unit, Rates (ABUR) of non-residential properties, duly conducting Physical inspection.

4. A unique Property Tax Identification number (PTIN) is generated for the new assessment, with a new House Number.

List of Documents Required :

i. Registered Sale Deed / Gift Deed / Partition attested by Gazetted Officer.

ii. Link Documents attested by Gazetted Officer.

iii. Building Sanction Plan (Xerox)

iv. Occupancy Certificate.

Payment of GHMC Property Tax Dues

For GHMC Property Tax Dues Payment, No manual transactions in Tax assessment, issue of special notice, issue of annual demand notices and receipts 100% computerization of assessments – notices – collection GHMC offers the following modes

** Handheld machines of Bill Collectors are integrated with central server

** 72 Mee-Seva Centres in GHMC limits

** Citizen Service Centres in all 19 Circles and GHMC Head Office

** Online, NEFT and RTGS modes of payment and 537 branches of 8 Banks

Answered Questions

My house number is 2-2-647/71. Please inform the PTIN number and what is the due amount in the name of owner M.KRISHNA MURTHY?

Property Tax Identification Number :

PTIN is a 10 digit number

** First number is common for all circles

** 2,3 digits circle number

** 4,5 digits Revenue wards

** the last 5 digits is the serial No.

Let me know whether GHMC is accepting offline property tax payments.

You can pay your Property tax in any of the eSeva centers located in Hyderabad and Secunderabad. You can also pay your Property tax at GHMC Citizen service centres

What is PTIN Number?

A unique PTIN” (Property Tax Identification Number) is alloted for each Tax Assessee. The PTIN/ASMT is Fourteen digits for old PTINs and Ten digits for new PTINs.

Some Important Information From Comments

Comments:

1. I own flat in LB Nagar, Chandrapuri Colony recently. We received the notice from municipality. We don’t know, what purpose notice were given. We stay in Suryapet. How do we proceed? Please give me the valuable suggestion.

2. We are building one more floor on the current double stared building. We are paying tax for this double stare building. How should we take the permission to update the tax details information for entire triple stared building?

3. We have vacant land in Mancherial Survey number 174/2. We did not get any property bills. How can we pay it? This is our grandmother property. We are paying only for house of her not able to vacant land. Please tell me.

4. My initial of sir name is typed as ‘G’, instead of ‘M’ from the date of purchase of the flat in 2009 in the mutation of name order and in the municipal records although I submitted copy of my sale deed and other documents showing my Sur name correctly at time of assessment of tax for the first time. It is simple mistake of letter ‘G’ for ‘M’. How to go about? What is the procedure? Is there any application format for correction?

5. I have registered the new flat in apparent in Sep 2015 (OC available)located in Hydernagar circle Kukatpally. I have not received property demand notice. How do I know that any tax is due. I do not know PTIN number to search the tax due online. How to generate PTIN no any procedure for new residents. Any help guidance is appreciated.

FAQ On GHMC Property Tax Dues

Frequently Asked Questions FAQ On GHMC Property Tax Dues

Q: What is GHMC Property Tax?

A: GHMC Property Tax is a tax levied by the Greater Hyderabad Municipal Corporation (GHMC) on all residential and commercial properties within the GHMC limits.

Q: What are GHMC Property Tax Dues?

A: GHMC Property Tax Dues are the unpaid property tax amounts that are due to the GHMC by property owners.

Q: How can I check my GHMC Property Tax Dues?

A: You can check your GHMC Property Tax Dues online by visiting the GHMC Property Tax website and entering your property details or the property tax assessment number.

Q: What are the modes of payment for GHMC Property Tax Dues?

A: The modes of payment for GHMC Property Tax Dues include online payment through the GHMC Property Tax website, payment through e-Seva or Mee-Seva centres, and payment through designated banks.

I want to know my PTIN number. We are leaving at Hyderabad.

How can I check my property tax dues? Please help me.

Every year property tax is hiked more than twice or thrice. I have purchased an old property. Why should I pay the penalty for this?

My PTI/Assessment number is 1129938646 and door no is 10-15/170/A. Property tax for the year 16-17 was assessed taking my plinth area as 800 sq ft while the actual plinth area is 605 sq ft. I submitted a

representation on 2.2.17 with all details including sale deed in the office of Deputy ommissioner,circle 12, chandanagar personally and obtained acknowledgement. For the current year viz 17-18 the revision seems to have been made on the basis of 800 sq ft instead of 605 sq ft. This is to be rectified. If correct amount is indicated I will pay tax in one go.

Mine is flat number 202 Hmr bommarillu apartments Mayuri Nagar Miyapur. What is my ptin and how much I have to pay?

My house number is 2-2-647/71. Please inform the PTIN number and what is the due amount in the name of owner M.KRISHNA MURTHY?

Information available from the Official Website :

Property Tax Identification Number :

PTIN is a 10 digit number

** First number is common for all circles

** 2,3 digits circle number

** 4,5 digits Revenue wards

** the last 5 digits is the serial No.

My PTIN number is 1129948134. What is the amount I have to pay?

I AM RESIDING IN VIJAYANAGAR COLONY, HYDERABAD. PLEASE INDICATE PTIN NUMBER FOR PROPERTY TAX PAYMENT. I WANT TO PAY THE TAX ONLINE.

Please let me know my property details and the tax that needs to be paid.

Is there any waive off in the interest rate? If so please inform.

I want to know my PTIN number for my property. Please help me.

I have applied for Building regulation scheme. Please let me know how can I pay my house tax in LB Nagar municipality area.

Please let me know how can I get my property tax receipts since 2005.

I want property tax payment receipt for 2015-2016. How can I get it from online?

How can I check due tax of open land by survey number?

What are the due dates for payments of property tax for FY 2017-18?

I WANT TO KNOW HASHAN NAGAR LONGAR HOUSE HYDERABAD. HOUSE NUMBER – 9-1-34/15/92

PLEASE GIVE TAX DUE AND PTIN NUMBER.

I submitted a representation on 30/2015 to GHMC authority enclosing my said property documents for retention of correct PTI NO1129922251 and DELETION OF WRONG PTI NO1129913410 ( in the name of K Sharma) issued in favor of the above address. I paid fully the property tax up till 31/3/2017 against above referred correct PTI number on 11/4/2016 vide yr receipt no.10120000234938 through online. To my surprise property tax dues are appearing in your website against the above wrong PTI which you may once delete all from your records.

Please let us know the names of all the bill collector area wise or circle wise so that we can check.

We are planning to build a small house with “Vishaka Rekulu” on first floor on my Owen house. So that what permission should be take from GHMC?

My House No. is 4-9-48, Uppal Circle, Sharda Nagar, Ramanthapur. What is my PTI number please?

How do I know my PTIN No?

New Assessment Tax Cash Receipt No.34 by Book No.3150 (2011-2012) Paid on 17.05.2011 at Rajender Nagar Circle no.06.

I don’t have pin no. How can I get?

I have paid my tax in April 2016 online. But I lost the receipt. I need to submit it for tax now. Can you please help me? How can I get the duplicate bill?

I stay in Malkajgiri paying property tax of Rs.3900/- p.a. since last 8 years. Recently some one from GHMC office came, took measurements and said that I have to pay Rs.15,000/- tax but not 3900/-. I do not know what is the basis for property tax calculation. The property tax calculator in GHMC web site is not working to check against house measurements. Also, I do not know the value for MRV in Malkajgiri area to manually calculate. (self occupied G+1 normal house – 240 Sq.Mtrs total plot area)

Can any one help here?

I forgot my ptin number. Can you help me? My door number is 1-8-17/41 Chikkapally.

How can I know the property by ptin no?

How much do I have to pay? Please let me know.

How can I find name of the owner on property tax?

How could I get my PTI number?

My address is

Door number 8-6-115/7

Balaji Nagar phase 2,

BN reddy nagar,

Vanasthalipuram

How can I get my PTI number and check and pay property tax online?

Please help.

Thanks,

Sunil

My house no is 3-4-134/4&5, flat no 101 skill legacy apartment. Barkatpura.

Please inform me my ptin no.

My door no is 16-2-669/B/403,Malakpet,Akberbagh.

Please give me my new PTIN no.

I have old PTIN no. How can I get new PTIN no?

Pit No : 1170600316

How much I have to pay for 2016 -17?

I have already paid property tax for the PTI No 1041707634 for the year 2015-2016 Rs.140/-. But I received message from GHMC for the year 2016-17. I have to pay Rs.9515/-. How is it which is very excessive and exorbitant. Please inform whom I have to approach and how much I have to pay tax?

I am unable to get tax bill online.

We are building one more floor on the current double stared building. We are paying tax for this double stare building. How should we take the permission to update the tax details information for entire triple stared building?

I own flat in LB Nagar, Chandrapuri Colony recently. We received the notice from municipality. We don’t know what purpose notice were given. We stay in Suryapet. How do we proceed? Please give me the valuable suggestion.

My HNo. is 856, HAL Colony, Gajularamam, Hyderabad.

I have tried all possible ways to get my PTIN number nut in vain. I tried calling the customer support/grievance number but no use. Than I tried calling the Zonal Commissioner number mentioned in the website but the phone was never answered. Can anyone hep me how to get the PTIN number?

We have vacant land in Mancherial Survey no 174/2. We did not get any property bills. How can we pay it? This is our grandmother property. We are paying only for house of her not able to vacant land. Please tell me.

I Smt. Parul Rani Chowdhury w/o Late G.K. Chowdhury (ex-service man), is having a house property at Kandiguda at the following address:-

H.No. 4-151, Kandiguda, Near Astha Laxmi Temple (PTIN No. 1010104082).

As per your Letter No. Proc.No. A/5326/2002 dt. 14.2.2003 my house is exempted from payment of Property tax till further notice, since I am widow of an ex-service man. I would like to know whether the exemption is still in existence? I would also like to know my correct PTIN No., since when I am typing my above PTIN No. the reply comes as “PTIN not found in assessment records.” Please reply immediately.

Kind regards.

Can any one help me in getting Boduppal area circle is included in the online payment system? I do not see my house property tax details at all. Please help me if you come across this type of situation.

H.no.2-3-935,Arunodayanager, Nagole, Hyd. R.r Dist.

Need the information for payment online payment.

Ptin number, circle number.

Paid the property tax for the year 2014-15 &2015-16 through online.

Details are

PTIN:: 1031122257

Transaction Id :: 120022159917206

Transaction Date & Time 28.03.2016

Mode Of Pay :: Net banking

Transaction Message:: Your Transaction is successfully completed

But I didn’t get any confirmation mail or message from GHMC regarding the same.complaint lodged at saroornagar on 16.06.2016 for adjustment of amount. But so far not adjusted. I am willing to pay present year property tax also. Today I got the bill for the year 2016-17, in which they asked me to pay the previous year’s amount, which I have paid already. Whom to approach now to avoid the confusion?

Paid the property tax for the year 2015-16 through online.

Details are

PTIN:: 1140210454

Transaction Id :: 6876400571060900

Transaction Date & Time 3032016

Mode Of Pay :: DEBIT CARD

Transaction Message:: Your Transaction is successfully completed

But I didn’t get any confirmation mail or message from GHMC regarding the same.To my surprise, today I got the bill for the year 2016-17, in which they asked me to pay the previous year’s amount, which I have paid already. Whom to approach now to avoid the confusion?

Need to know my PTIN umber for a flat in Raidurg

Flat E 802

My home is in Abhara ( opposite inorbit mall)

Plot no 3, Hyderabad Knowledge City

survey no 83/1

Raidurg Panmaktha village

Serilingampally Mandal

I have just now seen online after indicating my PTIN numbers (3)as I am having three floors two in my name and one in my son’s name that I have to pay property tax together with arrears of total Rs 930 for the year 2016-17. Bill collector has already come and taken payment of Rs.5652

by way of Cheque no/750611 dt11-03-2016 as property tax for the year 2016-17 .

The following are the details for which i have paid property tax for the current year2016-17:-

(1) HNo/12-2-823/A71(mew 528) PTIN1071212776 Rs2432

(2)H No/12-2-823?A71 (new No/528)PTIN107121377 Rs1960

(3)H No/ 12-2-823/A71new (528) PTIN1071212775 Rs1260

It is not known why I am being shown as not yet paid current year tax.I am having receipts from GHMC that Cheque has been received by them. The amount has already been debited to my account. Kindly clarify why it is shown that I have yet to pay. I have already paid property tax for current year. Why should I pay penalty of Rs.310 for each floor?

Or arrange to send bill collector urgently to my house for collecting dues if any as I am a widow a patient on bed aged 93 years no one to do things for me. Please help me on humanitarian grounds and oblige matter is urgent as i never ever failed to pay property tax far in advance.

PTIN NO-1160134011

Payment already made online but receipt not received on mail. Amount has already been deducted.

System is still showing the amount as dues.

I am a regular payer of House Tax since 1997-98, had receipts with me since then, even then also, I had been issued with Rs.3886/- due and every year asking me to pay. I used to show the receipts every time, and the BCs are taking a copy of the said Receipts. May please rectify your records.

My house no is 15-5-157 Osman Shah Hyderabad 500012. Please let me know status of tax due.

I have paid property tax for the year 2016-17 on 31-March-2016, I Have done online payment but still the due amount is not yet updated. PTIN NUMBERS are 1031105948 and 1031113023. We dint received any receipt as well.

Please check and do the needful.

My initial of sir name is typed as ‘G’, instead of ‘M’ from the date of purchase of the flat in 2009 in the mutation of name order and in the municipal records although I submitted copy of my sale deed and other documents showing my sur name correctly at time of assessment of tax for the first time. It is simple mistake of letter ‘G’ for ‘M’.

How to go about? What is the procedure? Is there any application format for correction?

My flat no in the premises of 2-2-1144/11/5, New Nallakunta, is printed as F3 instead F2 and the flat of F3 is printed as F2 in tax notices. Both the owners of F2 and F3 have submitted sale deeds and undertaking to correct it in June 2014. But till now no action is taken. So please kindly make corrections in records and intimate us.

MY ADDRESS IS H.No.10-1-80/2 flat no.303BJR residency Padmanagar colony Kharmanghat Hyderabad- 79. Can you please provide my PTIN NUMBER?

HOUSE NO:1-9-285/1/A/1, ADIKMET, RAMANAGARCUNDU, HYDERABAD.

PLEASE INFORM THE DUE AMOUNT AND inform PTIN number.

You can pay your tax online and your due id is 7338=00.

You have not paid tax.

I have paid house tax in April 12th 2016, My Name:P.Radha Krishna Murthy Amount Payed From Corporation bank through net banking . My Transaction Id:218953715, and amount 1323.58, My Mail id:parimimurti@gmail.com, My Tin Number:1031107133. Now I would like to download the receipt. Please inform me how to download the receipt and kindly please send me download link

I have paid the property tax through GHMC website, but I did not receive any email or message. Amount has been debited from my account successfully. What should I do now? When can I expect email or message confirmation? Could you please let me know.

I have registered the new flat in apparent in Sep 2015 (OC available)located in Hydernagar circle Kukatpally. I have not received property demand notice. How do I know that any tax is due. I do not know PTIN no. to search the tax due online. How to generate PTIN no any procedure for new residents. Any help guidance is appreciated.

I went to GHMC office, Khairtabad to request for a bill to be sent to as I always have to remember the time and keep old bill to pay my tax. The name of property owner has small mistake. They were unable to help me. I was told to look out for a person who roams in circle 10 area and ask for bill. I found this to be a ridiculous reply from a big GHMC office.

Please give me a reply that I can follow.

Also please inform me how to change the name of owner if owner has died. What docs are needed?

I am resident 24-64/29/1 Vishnupuri Malkajgiri. I paid an amount of Rs.1344/- on ptn no.1170602300 on 19.02.16. Later on I came to know one more ptn no,1170606125 for Rs.4074/- exists with same d.no. and name on the advice of help line. I approached Malkajgiri municipal office for transfer of pd amount of Rs.1344/- to other ptn no. They expressed their inability and told that I have to forgotten the amount paid and also told nearly 10,000 such duplicate nos. exists in malkajgiri. I request to kindly advice me for further balance amount on ptn no.1170606125.

Can I pay my property tax online through state bank of India?

My ptin no is 1180200479 paid by online. Ifsc- icic 0000104 vide UTR no UCBAH16042615965.

I am not getting property tax due from the beginning.

1030807608

My H.No. is 2-2-1105/5/10/6; Neeladri Apts., Tilak Nagar, Hyderabad.

Please inform my ptin no and due for my property tax.

I AM NOT GETTING PROPERTY TAX DEMAND NOTICE SINCE BEGINNING. EVEN THEN PAYING THE PT ONLINE.

PLEASE LOOK INTO THE MATTER AND ENSURE THAT I WILL BE GETTING THE DEMAND NOTICE, IN FUTURE.

MY HOUSE NO. IS 3-6-349/2, SAROORNAGAR MANDAL, RANGA REDDY DISTRICT.

REGARDS

I am not getting Property tax bill. My door no is 2-2-23/41/5/b DD Colony, Hyderabad 13. Already I kept my grievance but it is not rectified.

We lost the Property Tax file. Our house No is 12-10-416/10/3 Sitafalmandi, Secunderabad. Please send the tin No to pay the tax. Otherwise give the contact Bill Collector No.

Tax for 2015-16 for PTIN Nos.1090229221 and 1090229224 was paid on 22-4-2015 at mee seva centre. But notices Nos.2104 and 2106 d/ 11-2-2016 received again. Please verify and adjust the balance, which is evident in the computer itself.

You can get this number by coming into office.

Where can I get the Receipt Number and Date of my last payment?

I recently owned a property near Old Bowen pally Diary farm road , How do I get the PTI number? I had checked recently with the team members near Alwal they are saying if I pay them 3000 rupees then only they will give us PTI number .

I am trying to check online also whats the actual process of getting PTI number , I asked him should I pay via check and DD , he is saying this amount is not for the government , the tax amount would be different. This amount is for his own pocket to just allot PTI number. All my documents are crystal clear. I am not sure why he is asking me bribe. This comes under Alwal circle , when asked hei s saying as if you want to survive in this area , you need to pay this .

How to see GHMC property tax last paid details?

FLAT NO -5/22/146. PLEASE INFORM MY PTIN NO.

How much tax I have to pay? My house no is 18_8_239/A/10 Riyasath Hagar Hyd.

GK’s Ushodaya Apts SV Colony’s Society Election is due on 14 Feb. Notice has been served. I am contesting for the post of President 2016-17.

Would like to request for link :

a) which flats are still exempted from paying property taxes despite sold to civilians non-eligible category?

b) When your field official nameli Smt Jai Lakhsmi visited the bldg and matched records for registrations and updated?

c) we have a water problem. Who is keeping the record for opening closing of water valves to release water. There is no problem in Joy residency opp to us. It is water surplus though its bore wells are almost non functional. Is there a compromise?

d) Near house No 33-161/1 SV Colony Manjira Water is allowed to mix with sewage water coming from the same house. What action has been initiated?

e) what is the whatsapp no for Engineering ( Road Repairs) for SV Colony as there are several fatal accident spots created during Reliance Cable Laying but remained unattended as on today.

f) who is the sanitary inspector of this area? Life has become hell due to Buffalos held for commercial purposes. Have they got licenses?

My H.No.3-6-526,f 401, Himayath nagar. Can you please provide my PTIN number. As I searched with my name and door no online it is no record found. I want to check my property tax dues.

H.No:34-4/28,

PTIN no:1170900062

Circle : Malkajgiri

I had paid my house tax online three months back and I did not receive any receipt. Today when I checked property tax status still it is showing in dues.

How to get back my money?

MY HOUSE IS IN THE NAME OF MY FATHER N. SEETARAMAIAH AND ADDRESS IS SRT 557 (7-2-778) SANATHNAGAR, HYDERABAD – 500 018. AND QUESTION IS WHAT IS THE AMOUNT TO BE PAID FOR PROPERTY TAX UPTO MARCH 2016 ? I DON’T HAVE THIS PTIN NO. WITH ME RIGHT NOW. PLEASE INFORM ME AT THE EARLIEST.

A unique PTIN” (Property Tax Identification Number) is alloted for each Tax Assessee.

The PTIN/ASMT is Fourteen digits for old PTINs and Ten digits for new PTINs.

H:NO:7-48 Shantinagar colony Chandanagar

Serilingampally:2

circle:12

PTIN:1129904755

I have three room’s 90syd’s. I am getting 2,250 before 500. My house is covered by asbestos sheets. I can not get so much big amount. Can you please check and settle the correct amount?

Thank-you.

I have paid my property tax online. I didn’t get the receipt.

What to do now ?

My no is drno8-18-273 KARMANGHAT CRICLE 3 PTIN NO 1030805237

How do I know my money has reached?

I would like to know how much do I need to pay my property tax due. My house no.5-5-35/2/4 plot no.115.prasanth nagar kukatpally.

I would like to know how much do i need to pay my property tax due.

My house no :B-70 ,Dr no:3-32-357.Allwyn colony phase-1 kukatpally RR DIST. HYD.

I am receiving Two PTI Nos. with Double Bills for my same single flat, past four years. My allotted House property Tax PTI No is 1160116427, for which I have been paying my House Tax regularly on time. But, along with I am also receiving another, one more second PTI No 1160116409 on my name, again with generated second Bill stating with previous year pending amount.

I have brought this grievance to the notice of GHMC office several times, and requested to delete the error PTI No.1160116409 with second bill, lodged my Grievance complaint(Ref.No.2014-06-W092705), But till date No action was taken.

Still I am receiving Two PTI Nos. with Double Bills for my same single flat. Kindly I request your good office to take immediate necessary action in deleting the erroneous second PTI bearing No 1160116409 on my name, without any further delay, and kindly stop sending the second error bill.

Thank you,

P.Balasubramaniam, Alwal circle-16, Secundrabad

Who has to pay the tax for, 12-5-103/5/202,vijayapuri colony,Karnataka secunderabad-500017

I have property tax through online on 21st April 2015 but I could not get the receipt. Again I have paid through online on 23rd April 2015. Again I could not get the receipt. Each time I have pass an amount of Rs.2924.49.

My PTIN no is 1140213684

Please credit both the amounts to property tax account for two years.

K Surendranath

Bangalore

Regarding my property tax bearing pti no 1041629453 I paid the tax amount on April 15th 2015 for 2015 & 2016

Still it is asking me to pay the dues.

PTIN 1010408477, KAPRA.

Same is my case. I paid on 16-04-2015, still it is asking me to pay again surprisingly with penalty. If I pay now will it be adjusted for future payments?

Pending Property Tax Dues as on 31st March,2015

Sujatha

My house no is 12-1-669 /3 ;shanthinagar; north lalaguda and I want to know my pti no

Property tax paid on 30-5-2015 through online at me seva counter.

But dues are still outstanding

It is advisable for the Commr. to consider for extending date for paying tax with discount at-least upto end of June. If not competent better to send proposals TO sRI kcr WHO IS MAGNANIMOUS TOWARDS SENIOR CITIZENS

Every year I used to pay property tax through net. But now this year the net is not responding,hence there is no way except approaching Mee seva,where they charge more service charges. Can authorities look in to,update the new system of payment tho net? So time,money will be saved &people will be happy in paying Tax in time?

I paid property tax on 28/2/14. My receipt number is 108002280215340

My tin number is 1181108409 to bill collector but still showing total due.

Applied for name of change three months ago until did not change name. My assessment no. 1041803807.

I did not get the property tax payment receipt. I paid online and it showed some error, but the amount did get deducted. Whom should I reach out to resolve this and get a receipt?

I have paid PT.

The details are

PTIN No. : 1140213340,

Trans.No.ID : T1566364666 DT.30/4/2015. But the amount is not updated and due amt is showing in the portal. I have several times brought this matter to the concerned officers. But no use. My grievance no.2015_05_W163032. Kindly do the need full.

I NEED HOUSE TAX RECEIPT ABSTRACT FROM 1.4.1992 TO TILL DATE FOR PROCESSING LOAN IN BANK. HOW CAN I GET ONLINE. I STAY AT TIRUMALA HILLS ASMANGADH,DILSUKHNAGAR.

MY DOOR NO 16.2.751/A/31/E/51 ROAD NO.3. PLEASE HELP

My PTI No. 1129922124 (11.serilingampalli-1) as per this PTI No. An amount of Rs.1234/- was the due my property tax and the same was paid vide Receipt No.8305923440650900 dated 31.03.2015 through online payment against the PTI No.1129922124 for 2014-2015 . Again showing dues for the last financial year 2014-2015. Kindly verify the receipt of tax for the year 2014-2015. My House No.is 2-49/3/G-1.

I have paid property tax to PTIN No.1140213330 on 30.04.2015 for the year ending 31.03.2016 an amt of 3458/- at KS Net centre,

HMT Hills, kukatpally. The tran.

ID is T1566364666, 30-4-2025.

But to my surprise the amount is still outstanding showing the tax dues. Kindly verify

I have paid tax for the year 2015-2016 through inb for an amount of rs 6169/- on 5/5/2015 and the account was debited to my account, but your books are still showing as due.

The particulars are as follows:

INB GHMC 05135984906620IGooZDEJX5

Amt transferred to account no 31970620859

Please arrange to rectify the records

My PTIN NO is 1181211613

H.No 12-12-120/3

Secunderabad

Discount of 5 % MAY PLEASE EXTEND ATLEAST UPTO END OF MAY. SO THAT NUMBER OF SENIOR CITIZENS MAY AVAIL THE BENEFIT AND GHMC MAY GET CONSIDERABLE AMOUNT UNDER TAX

I have paid the property Tax upto 31-3-2011 vide receipt No 56, Book No 3389 for the house located in Rakshapuram .No 18-8-254/102. PTIN: 1041809867. Kindly let me know the as on date tax due for this house.

In plot no 1_11-252/11-2/202 motilalnagar Begumpet under circle no.18

We have not received five bills for property tax. Kindly depute the bill collector to hand over the payment

My son’s flat is yet to be handed over to me by the Seller i.e. Siddamsetty’s Himasai Heights,Jawahar nagar, st no 6,Hyderabad 500 020. The Flat address is Flat no 506,Siddamsetty’s

Himasai Heights,Jawahar nagar,St.no 6,Hyderabad 500 020.GHMC Circle no 9,Ward no 93 Gandhi nagar

Door no. 1-1-365/A I did not receive any Assessment Order from the GHMC. I do not know the PTIN

My online Query no. 2015-04-W157521 dt.24-04-2015 and 2014-04-W157943 dt 26-04-2015 are yet to be responded. My efforts with the Seller to know the PTIN drew blank. If I am given Asst.Order or PTIN can I pay the property tax online?

I am unable to find out the ptin using the assessment no.

Please confirm, so that payment can be done. Also confirm the dues.

Assessment no – 1055021405

It is quite disturbing to note that so many issues mailed remain unresolved by GHMC. None of the officials or the staff respond in a responsible way. Need to streamline more for the benefit of the common people who are willing to pay online. When I wanted to see the tax arrears, I just cannot see and it is taking me to different domains, which have no relevance at all with GHMC. Is there anybody looking into the queries of IT?

How can I Pay PT in E seva By cheque or Cash?

GHMC portal has not been functioning since yesterday. Not able to see the property tax due position for making online payment before 30th April to avail the discount scheme announced by the Corporation. Can we expect quick resolution by the IT Department of the Corpn ?

Online payment is excellent, you can get the bill via your email.

Dear satish…

You are the only one saying that online payment is excellent…

I paid my property tax on 30th march 2015.

Till today 12-may 2015 the data base is not updated..

Pity on you for the wrong posting.

My House No .1-25-89, Vikas Colony, Gollagude, Doddi Alwal, near Subash nagar. What is my PTIN number for paying Property Tax on-line?

Thanx & Regards,

S.K.Dinesh Kumar

I paid property tax upto March,2015(2014-16)Request dues upto 31st March, 2016. I have not received any demand note for property tax from GHMC Officials.

I have paid tax through idbi net banking. Amount has been deducted from my account but I didn’t get any success message. Now what shall I do? Should I repay again? Or it will be credited automatically?

My complaint No.2015-04-W154944 and 2015-04-W1549546 dt 10-4-15 & 11-4-15 is yet to be resolved. Property tax for 2014-15 paid by NEFT to ICICI Bank given in above complaint. In view of arrears being shown, I am unable to pay tax for 2015-16 and avail 5% discount. Call to respective Bill collectors is futile. They say their number wrongly mentioned by department. WILL I GET POSITIVE RESPONSE IMMEDIATELY AND ENABLE ME PAY TAX BY 30TH APRIL 2015?

Whether 5% discount is available for property tax if paid by April 30 2015?

As per notification, Yes – discount availble. If you are paying on line , you can see the actual due and due after 5% discount.

My PTIN is 1141514038. House No.15-21-M-352/1/G1. On 17.04.2014 I wanted to pay the property tax for 2014-2015 through ONLINE. While doing the transaction ON-LINE there was some disturbance in the last step. Due to the unexpected disturbances although money is deducted from my Andhra Bank account I could not complete the process in full and did not get the GHMC Receipt. Under this pressure and panic I tried again and again to get the receipt but failed to get. But in this panic situation three (3) times money is deducted from my Bank account. Luckily I got the receipt for all three payment Transaction from Citrus Pay. The payment details are given below :

Si.No | Merchant Order No. | Transacion Ref No | Date & time | Amount :

(1) 1141514038 _ GHMC2 CTX 1404171127128161793 Apr 17,2014 04:57:12 PM 1772.77 INR

(2) 1141514038 _ GHMC14 CTX 1404171132232715921 Apr 17,2014 05:02:23 PM 1772.77 INR

(3) 1141514038 _ GHMC11 CTX 1404171143478747305 Apr 17,2014 05:13:47 PM 1772.77 INR

I request you to kindly confirm receipt of payment adjust the amount deducted from my bank account towards the property tax for the year 2014-2015, 2015-2016 and 2016-2017.

Please resolve the issue at the earliest since the due date for paying property tax for 2015- 2016 already commenced and the local GHMC Circle office in Balaji Nagar, Kukatpally has intimated me tax for 2015-2016 is due from me.

Thanking you

with regards

viswanathan

I paid property tax on 13-4-2013 for PTIN 1041614983,TXN REF is 151141156, but I did not received any receipt for the same and also dues are not corrected after payment in the property due portal. This tax was paid for year 2015-2016 to avail 5% rebate.

Many users are suffering with this parallel systems of failure?

No process of collecting tax finally works!

If GHMC cannot use a basic online tax collection and update the users please shut down your site and send those Bill collectors who still expect more out of tax payers.

Please kindly let me the fate of grievance no.3308 dt.25.3.2014 and 2015-4-w154564 dt10.4.2015 regarding imposing penalty on p.tax even though the tax dues are paid in time. It is because of non-updation of manually collected bills in system. Please let me know the status at the early date.

I have paid through debit card on 9/04/2015,but in GHMC site still dues are showing?

I have paid my property tax online. I didn’t get the receipt.

What to do now ?

My no is drno8-2-120/114/B/2.

How do I know my money has reached?

My name is Vallala Anuradha. My house no.5-34-32-317

I want PTI number.

Which are the banks in Secunderabad accept payment of property tax?

I have already requested to let me know the dues for the current year

It is pity to receive cell phone messages from ghmc to pay property tax before 30th april, but its website does not disclose the dues even today, the 8th april. How can we pay?

The site is working properly and you can Know your Property tax dues

PTI No.1180901821, Circle 18

I have been out of station, and on my return. When going to the GHMC office Office at Secunderabad, they have informed me that the last day for payment was 31.05.2015, as updation of the server has not been initiated. Kindly inform when the payment could be made? Your urgent response is requested.

Thank you

Not able to pay as credit/debit card box is not functioning

How much amt should I pay for property tax?

My house No. 1-1-380/8 ASHOK nagar Extn, Hyderabad—500 020. Circle No.9. What is the property tax due for the F.Y. 2015-16?

What is my PTIN. No.?

Requested Property Tax Dues for the Academic Year 2014-15(i.e.) as on 31st March,2015 dues.

Tax assessed for financial yea(April-March) not for academic year: June to May:

Request property tax dues for the academic year 2015-16(as on 31st march,

2016 dues

please reply to:

H.No.16-11-16/M/2/A, East Prashanth Nagar Colony, Nr.O/o RTA, Moosarambagh,

Hyderabad-500 036

pti no;1151702270

15-qutbullapur

I have a vacant plot. Do I need to pay any tax for that?