GHMC : Calculation of Property Tax Hyderabad

Organization :Hyderabad Municipal Corporation Telangana

Facility :Calculation of Annual Property Tax

Applicable State/UT: Telangana

Home Page : http://www.ghmc.gov.in/

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

GHMC Calculation of Annual Property Tax

You can follow the below guidelines to Calculation of Annual Property Tax Dues.

Related / Similar Facility :

GHMC Birth/ Death Search & Status Online

Go to the above link,click on Our Services tab in Main Menu. Then click on

Property Tax ->Property Tax ->GHMC -> Calculate your Property tax option.

Follow the below steps to proceed for annual calculation of property tax.

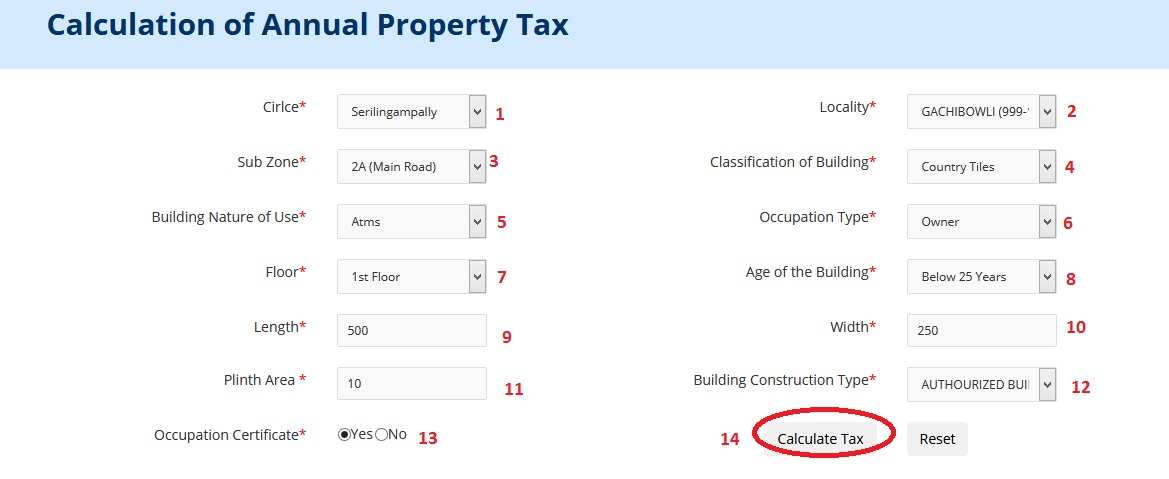

Step 1 : Select Your Circle*

Step 2 : Select Your Locality*

Step 3 : Select Your Sub Zone*

Step 4 : Select Your Classification of Building*

Step 5 : Select Your Building Nature of Use*

Step 6 : Select Your Occupation Type*

Step 7 : Select Your Floor*

Step 8 : Select Your Age of the Building*

Step 9 : Enter Your Length* (Ft)

Step 10 : Enter Your Width* (Ft)

Step 11 : Enter Your Plinth Area * (Sq.fts)

Step 12 : Select Your Building Construction Type*

Step 13 : Select Your Occupation Type *

Step 14 : Click Calculate Tax Button

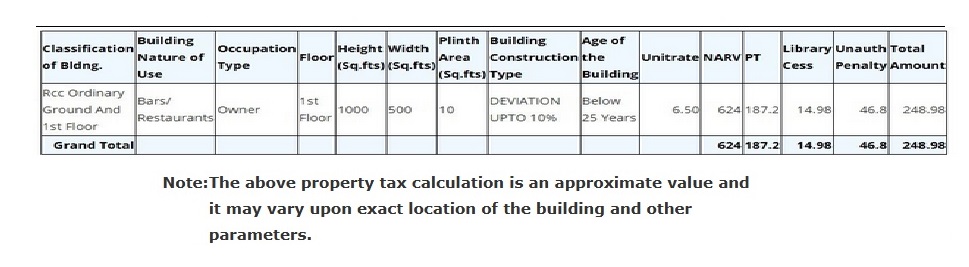

You will get the total amount calculation as below.

FAQ On GHMC Property Tax

Frequently Asked Questions (FAQs) on GHMC Property Tax

How is my PTIN No. generated :

PTIN is a 10 digit number

First number is common for all circles

2,3 digits circle number

4,5 digits Revenue wards

the last 5 digits is the serial No.

How to pay my Property tax online :

You can pay your Property tax in any of the eSeva centers located in Hyderabad and Secunderabad. You can also pay your Property tax at GHMC Citizen service centres.

How do I calculate my Property Tax :

Annual Tax is Calculated as 3.5 X Total Plinth Area in Sft X Monthly Rental Value per Sft in Rs.

Payment of Tax Dues :

** GHMC offers the following modes of payments in collecting Property Tax from the Citizens.

** Debit/Credit Card Payment from our website** ghmc.gov.in

** mee-Seva Counters

** AP Online Service Delivery

** Citizen Service Centers

** Bill Collectors

** State Bank of Hyderabad Branches

** Cheque/DD should be in the favor of “COMMISSIONER, GHMC”

** Hyderabad Municipal Corporation. Property Tax Identification Number (PTIN) is given to each taxpayer for each property. This number is unique in itself and is of Fourteen digits for old PTINs and Ten digits for new PTINs. You can enter this number in the website and make the payment online.

What are the online services provided by GHMC ?

GHMC is the official portal of Greater Hyderabad Municipal Corporation. It is a one stop place to avail the online services provided by the Corporation.

The online services provided are :

Search facility on Birth Verification, Death Verification, Trade License Payments, Engineering Work Status, Registered Contractors, New House Numbers, Building Permission Status

A unique Grievance Redressal System called Parishkruthi to increase the transparency and efficiency in the system.

Information about the Corporation, Budget, Citizens’ Charter, Building Permission Procedure, Building Fee Details, new FSI Policy, Rationalisation of House Numbers, Properties on Lease and such other information.

Application forms for Birth Certificate, Death Certificate, Self Assessment, License for Advertisement, Building Application Form, Building Construction Permission, Balika Samriddhi Yojana, Thrift & Credit Application Form, Transfer of Property etc. can be downloaded from the net.

About Us

In 1937 Banjara Hills, Jublee Hills etc are merged into Jublee Hills Municipality. In 1942, the Corporation status has been removed due to certain issues. In 1945 Secunderabad Municipality was formed. In 1951 it became Corporation.

1869 the Kotwal-e-Baldia, the City Police Commissioner, begins to look after the Municipal Administration. 1869 Sir Salar Jung-I, the then Nizam, constitutes the Department of Municipal and Road Maintenance and a Municipal Commissioner appointed for Hyderabad Board and Chadarghat Board

Some Important Information From Comments

Comments:

1. I have Paid my property tax online for the year 2015-16 on 8th April 2015. I could not get the receipt for it instead a message with GHMC format as transaction successful and RRN number as 000094100422. I have seen online and still the tax is shown as due only which shows payment not updated. Please confirm payment and and let me know, how to get the receipt.

2. I paid tax on 24/ 03/2016 as 101 (rupees one hundred and one) towards my house tax at Chikkadapally e-Zeba as PTIN Number 1030604442 for 2025 to 31/03/2016. Today, I wanted to pay for 2016-2017 the tax it shows as 3549. I stare of 103. Please clarify, so that I will pay the balance.

Features of GHMC Property Tax

The Greater Hyderabad Municipal Corporation (GHMC) Property Tax is an online portal designed to facilitate property tax payment for citizens in Hyderabad, India. Here are some of its features:

Easy Registration:

Citizens can register their properties on the GHMC Property Tax portal by providing basic details such as the property address, owner name, and contact information.

Online Payment:

The GHMC Property Tax portal allows citizens to pay their property tax online using various payment modes, including debit/credit cards, net banking, and e-wallets.

Quick Payment:

Property tax payment on the GHMC Property Tax portal is quick and hassle-free, and citizens can receive their payment receipts instantly.

MY DAUGHTER IS OUT OF STATION. SHE ASKED ME TO PAY PROPERTY TAX FOR 2017-2018. I DON’T HAVE ANY IDENTIFICATION REFERENCES. HOW CAN I PAY THE PROPERTY TAX?

I Submitted detailed representation on allotment of two PTI nos for the same house and the owner and in which I requested the concerned GHMC authority to delete my PTI no i.e 1129913410 issued in the name of K Sharma. My original PTI no1129922251 issued in my name i.e K B V D P SARMA is correct and that should be in your records. For this the registered LEASE DEED and my property documents were enclosed with said representation, which was duly acknowledge by GHMC on 30/1/2015.

2) I have paid the Property Tax upto 2016-17 in full against above correct PTI No. 1129922251 on 11/4/2016 through online and the receipt no is 10120000234938

3) I saw in GHMC website that an amount of Rs.238/- is shown as due agast the above wrong PTI no.1129913410 which may please deleted from your records once for all

Please furnish account details of property tax paid during last 3 years for PTIN 1141203587.

How can I know my PTIN number?

How can I know my PTIN number?

How can I calculate the house tax?

How can I fund out PTIN no from House no?

I paid tax on 24/ 03/2016 as 101(rupees one hundred and one)towards my house tax at Chikkadapally e-Zeba as PTIN No: 1030604442 for 2025 to 31/03/2016. For door no 6-2-66 Vanasthalipuram,circle3,LBnager. Today I wanted to pay for 2016-2017 the tax it shows as 3549. I stare of 103. Please clarify so that I will pay the balance.

I have paid property tax but not yet updated in the system. When I tried with pin no which 14 digit is not responding?

I paid ghmc property tax dues on Sunday 12/6/16 through meeseva center but in the online it has not been updated. Why?

HOW CAN I GET PTIN FOR DOOR # 9-4-131/1/N/11?

PLEASE UPDATE.

If you want know your property tax number then you have to go your area circle office meet the ghmc officer and your door number and your area detail told to the office and he can told to you what is your PTIN….

Kindly intimate my PTIN nos, for House Numbers 16-11-16/1/1/4/1 and 16-11/16/1/1/4/1/FF/1. I want to pay my tax.

How will I get property tax paid details?

Enter your PTIN/ASMT (Property Tax Identification Number) to check the Dues in the below link.

https://www.ghmc.gov.in/

450sqft. Tax

How do I know my PTIN NO?

Last 10 years not paid tax. I have circle&assessment.no

My ptin no is 1181106782 area parsigutta. I am having 40yards small house. I am aged 75 yrs poor family. My tax showing as rs.19880/-. I am poor and living in slum area this much amount I am unable to pay.

I have Paid my property tax online for the year 2015-16 on 8th april 2015 . I could not get the receipt for it instead a message with GHMC format as transaction successful and RRN no as 000094100422. I have seen online and still the tax is shown as due only which shows payment not updated. please confirm ayment and and let me know how to get the receipt

Narasimhaiah D

3-15-LGF/37 MANSOORBAD LB NAGAR