ctd.tn.gov.in Verification of CST Form Tamil Nadu : Commercial Taxes Department

Organisation : Tamil Nadu Commercial Taxes Department

Service Name : Verification of CST Forms

Applicable States/ UTs : Tamil Nadu

Website: https://ctd.tn.gov.in/forms-status

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

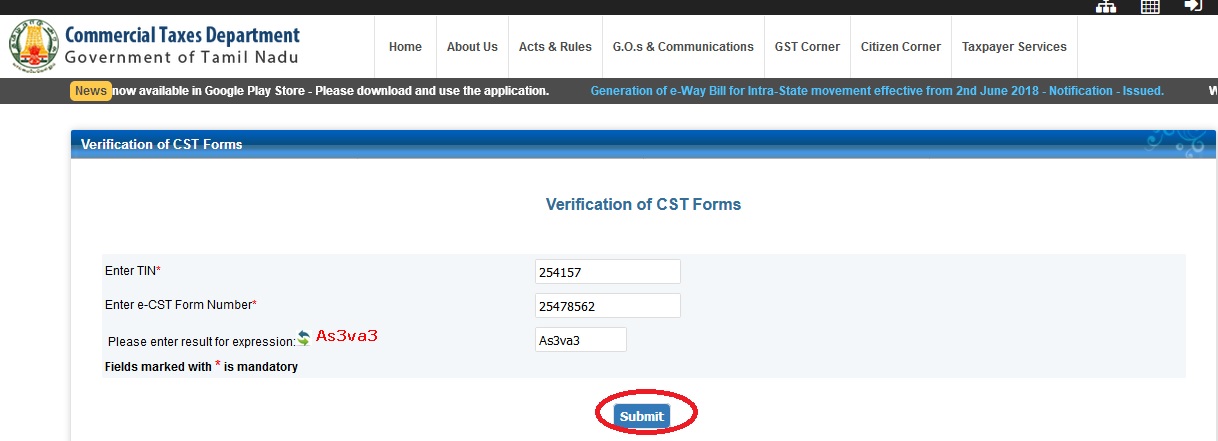

CTD TN Verification of CST Forms

Please enter the velow details to Verify your CST Forms,

Related : CTD Tamil Nadu How to E-Register : www.statusin.in/15841.html

1. Enter TIN*

2. Enter e-CST Form Number*

3. Please enter result for expression

4. Click on the Submit button

Note : Fields marked with * is mandatory

Verify Turnover Declaration Certificate

Field marked with * are mandatory

1. Enter Dealer TIN*

2. Enter your Certificate No. *

3. Click on the Submit button

TDS Certificate Search

Enter the Following details to Search TDS Certificate Details,

1. Enter Acknowledgement Number

2. Enter TDS Certificate Number

3. Enter Challan Number

4. Enter Contractee TDN

5. Click on the Search button

FAQ On GST

1. What are the Payments to be made in GST regime?

In the GST regime, for any intra-state supply, taxes to be paid are the Central GST (CGST), going into the account of the Central Government) and the State/UT GST (SGST, going into the account of the concerned State Government).

For any inter-state supply, tax to be paid is Integrated GST (IGST) which will have components of both CGST and SGST. In addition, certain categories of registered persons will be required to pay to the government account Tax Deducted at Source (TDS) and Tax Collected at Source (TCS).

In addition, wherever applicable, Interest, Penalty, Fees and any other payment will also be required to be made.

2. Who is liable to pay GST?

In general, the supplier of goods or services is liable to pay GST. However, in specified cases like imports and other notified supplies, the liability may be cast on the recipient under the reverse charge mechanism.

Further, in some notified cases of intra-state supply of services, the liability to pay GST may be cast on e-commerce operators through which such services are supplied.

3. When does liability to pay GST arises?

Liability to pay arises at the time of supply of Goods as explained in Section 12 and at the time of supply of services as explained in Section13.

The time is generally the earliest of one of the three events, namely receiving payment, issuance of invoice or completion of supply. Different situations envisaged and different tax points have been explained in the aforesaid sections.

4. What are the main features of GST payment process?

Payment processes under GST Act(s) have the following features :

** Electronically generated challan from GSTN Common Portal in all modes of payment and no use of manually prepared challan;

** Facilitation for the tax payer by providing hassle free, anytime, anywhere mode of payment of tax;

** Convenience of making payment online;

** Logical tax collection data in electronic format;

** Faster remittance of tax revenue to the Government Account;

** Paperless transactions;

** Speedy Accounting and reporting;

** Electronic reconciliation of all receipts;

** Simplified procedure for banks

** Warehousing of Digital Challan.

Functions of Tamil Nadu Commercial Taxes

The Tamil Nadu Commercial Taxes Department is responsible for the administration of the following taxes in the state of Tamil Nadu:

** Value Added Tax (VAT)

** Central Sales Tax (CST)

** Luxury Tax

** Entertainment Tax

** Betting Tax

** Entry Tax

** Advertisement Tax

** Motor Vehicles Tax

** Stamp Duty