Kerala Taxes : VAT e-Consignment Declaration

Organization : Kerala Commercial Taxes Department

Facility : e-Consignment Declaration

Home Page : http://www.keralataxes.gov.in/

For More Details Here :www.statusin.in/uploads/3959-KVAT_eDeclaration_UM_01012010.docx

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

Kerala Taxes VAT e-Consignment Declaration

** Commercial Taxes Department, Government of Kerala became the 1st among States in introducing e-filing VAT/CST/KGST return to all registered dealers and e-Payment of tax. Since then, many e-Services like, e-Registration / renewal, online applications are facilitated for the benefit of the trader community.

Related / Similar Service :

Kerala Taxes e-Payment of VAT

** Now the Department introduces mandatory e-Consignment Declaration from 01-12-2011.

** This Through this facility of Kerala Commercial Taxes Department for the dealers could declare the details of consignments passing the Commercial Taxes checkposts well in advance before the consignment reaches the Kerala State Boundaries.

Please note the following,

** No registration is required for availing this facility.

** The e-Consignment Declaration token in Form 8F is generated immediately after submission of consignment details.

** It is required to carry a print out of Form 8F generated by the e-Consignment system of KVATIS.

** Please note you could modify the details till you submit the application and takes the printiout. Please note down the Token Number and Vehicle Number, which are required to select the token record for modifications if any required and for submission of e-Consignment declaration.

** For further queries, please send your valuable feedback to e-mail : itmc AT keralataxes.gov.in

FAQ On e-Consignment Declaration

Frequently Asked Questions (FAQs) On e-Consignment Declaration

What is a Declaration?

A declaration is a self attested consolidated details of goods contained in a transporting vehicle..

What is an e-Consignment Declaration?

The process of capturing the goods details for a particular vehicle, well before, it reaches the Kerala State Boundaries using the KVATIS online e-consignment Declaration (Link available in the official website of Kerala Commercial Taxes Department).

Who are all filing e-Declaration?

Any consignor / consignee / transporter has the facility to declare the details of consignment in advance, while the goods are loaded in the vehicle. All users can directly login without username and password.

How To File e-Consignment Declaration?

Dealers having an internet connection can do online e-Consignment Declaration. Open any browser (like Internet Explorer, Mozilla Firefox etc)

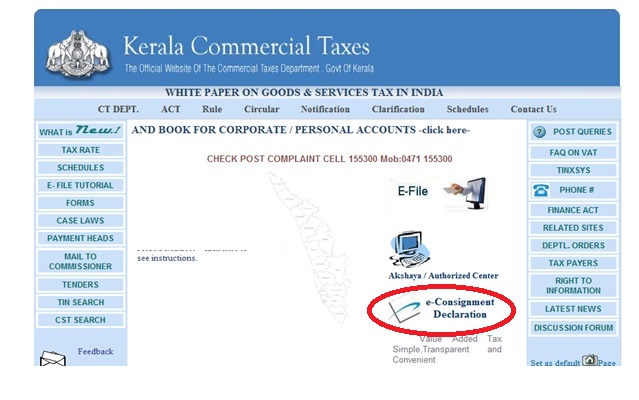

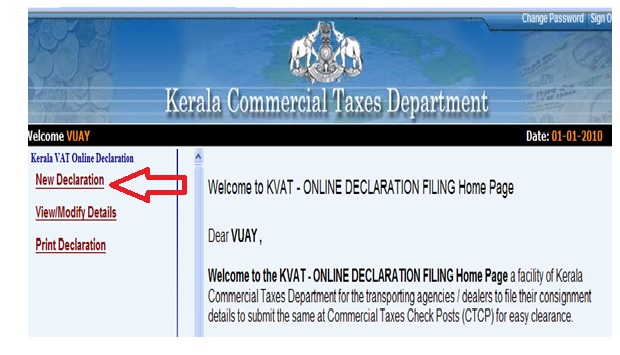

Click e-Consignment Declaration link. All Unregistered dealers can directly login without username and password. The following screen appears.

Use the following links,

** New Declaration ? to enter new goods declaration

** View / Modify Details ? to modify the declaration already entered.

** Print Declaration ? to print the e-Consignment Declaration

** Latest Instructions? latest information on e-Consignment Declaration.

** Download User Manual ? user manual on e-Consignment Declaration

** Download Commodity Group List ? list of all the 7800 commodities linked to its corresponding commodity group (total 320 commodity groups).

** Contact Details ? Telephone numbers / email ids of Kerala Commercial Taxes Department help lines.

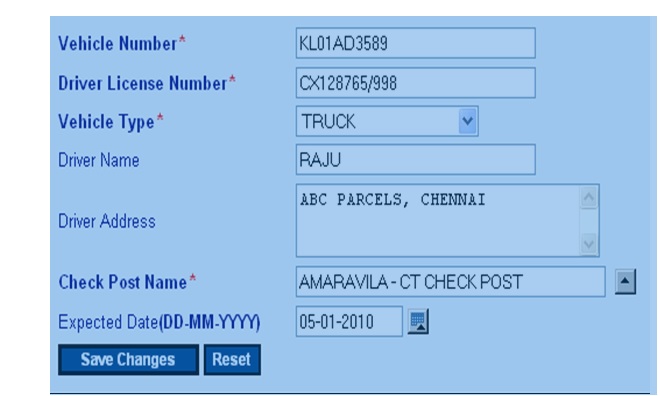

The following screen appears on clicking the link New Declaration. Enter the vehicle details of the consignment.

On saving, system navigates to the Consignment and Commodity Details.

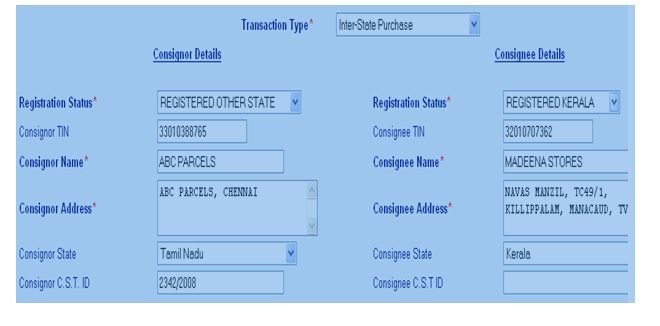

Enter the Consignment Details.

Modify Declaration :

** The following screen appears on clicking the link Modify.

** Enter both Token Number and Vehicle Number to fetch the exact data.

** On clicking the edit option, vehicle details can be modified.

** On clicking the Select option, all consignments would be listed. Click edit option to modify any consignment / commodity details.

Print Declaration :

** The following screen appears on clicking the link Print.

** Enter both Token Number and Vehicle Number to fetch the exact data.

** On clicking the Select option, the e-Consignment Declaration would be displayed.

** Select the option “I Accept”, and press SUBMIT to Print the e-Consignment Declaration.

Features of Kerala Tax VAT e-Consignment Declaration

The Kerala Tax VAT e-Consignment Declaration (e-CD) is an online system that allows taxpayers to declare consignments of goods that are subject to VAT. The e-CD system offers a number of features that make it easier and more convenient for taxpayers to comply with VAT regulations.

Some of the key features of the e-CD system include:

** Online filing: Taxpayers can file e-CDs online, 24 hours a day, 7 days a week.

** Real-time tracking: Taxpayers can track the status of their e-CDs in real time.

** Automatic generation of challans: The e-CD system automatically generates challans for taxpayers, making it easy to pay VAT.

** E-Way Bill integration: The e-CD system is integrated with the e-Way Bill system, making it easy for taxpayers to generate e-Way Bills for their consignments.

The e-CD system is a valuable tool that can help taxpayers to comply with VAT regulations more easily and efficiently. If you are a taxpayer who is subject to VAT, I encourage you to use the e-CD system.

How can consumer generate e-consignment form?

How can I cancel an e-declaration?

HOW CAN I CHANGE PASSWORD OF E-DECLARATION ? PLEASE HELP ME.

How can I cancel eDeclaration after print?

I AM A CARTON MANUFACTURER. MY CUSTOMER IS IN KERALA ITSELF. BUT HE WANT TO TAKE CARTOONS TO TAMILNADU FOR PACKING VEGETABLES AND RETURNED BACK TO KERALA FOR EXPORTING. HE HAD GIVEN ME HIS PASSWORD, SO THAT I CAN ENTER INTO HIS SITE FOR E-DECLARATION. IN E-DECLARATION I USE TO MENTION AS INTER STATE STOCK TRANSFER. BUT STILL WE GOT PROBLEMS. SO PLEASE LET ME KNOW THE CORRECT PROCEEDINGS. WE DON’T WANT TO CHEAT THE GOVERNMENT.

We are manufacturing paper bags&send to various customers in Kerala. So far fleet owners used their ID for transport. Now they ask passwords of our buyers. Buyers are not interested in giving either password or declaration. Shall we we fill in the form 8f &submit to you by online? Please clarify