ESIC Challan Online Payment Monthly Contribution : Employees State Insurance Corporation

Organisation : Employees State Insurance Corporation (ESIC)

Service Name : ESIC Challan Online Payment (Monthly Contribution)

Applicable States/UTs: All Over India

Website : https://www.esic.in/ESICInsurance1/RevenueOne/Monthly%20Contribution/eChallan.aspx

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

How To Do ESIC Challan Payment?

Employees State Insurance Corporation (ESIC) enables members to pay their challans online.

Related / Similar Service :

ESIC Instructions to Deploy Security Certificate

Individuals can make their ESIC challan (Monthly Contribution) payments online.

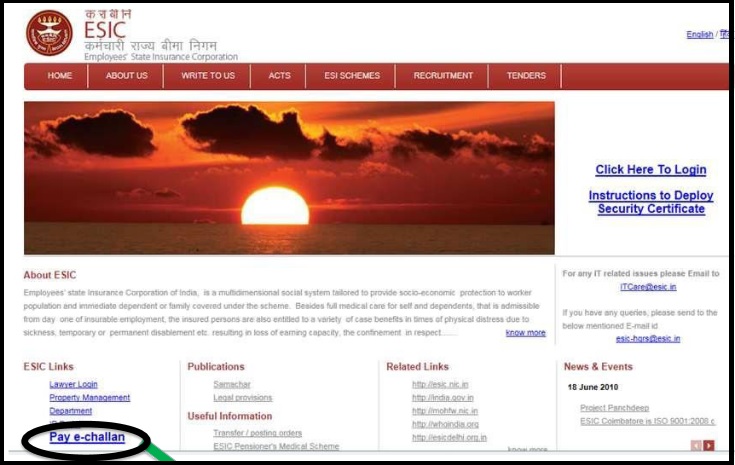

Step-1 : Visit the official website of ESIC i.e. https://www.esic.in/

Step-2 : Click on Pay e-challan to proceed for online payment of MC

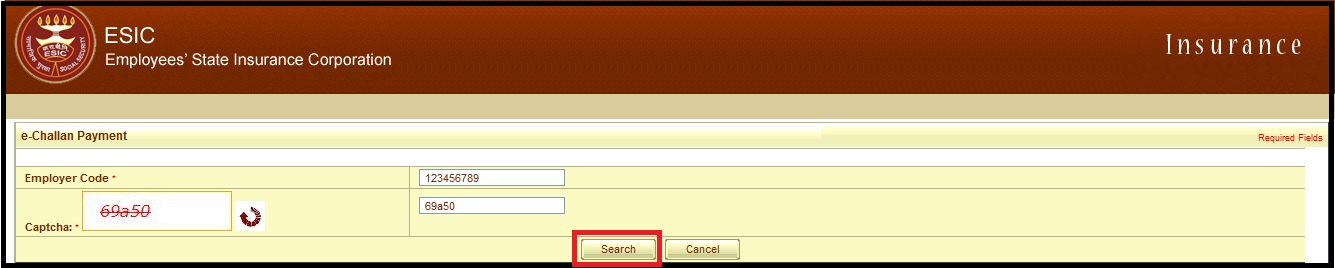

Step-3 : Enter the Employer Code and Captcha and Click on ‘Search’ to proceed to challans

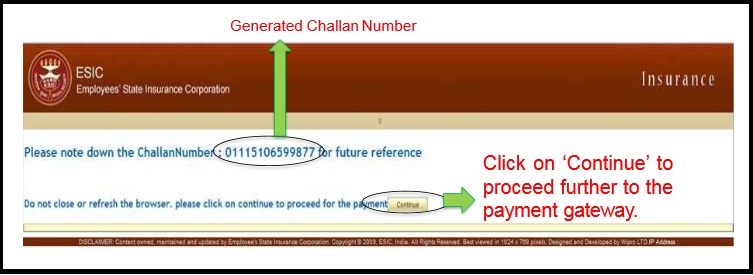

Step-4 : Select the Challan Number to continue for the Payment

Step-5 : Click on ‘Continue’ to proceed further to the payment gateway

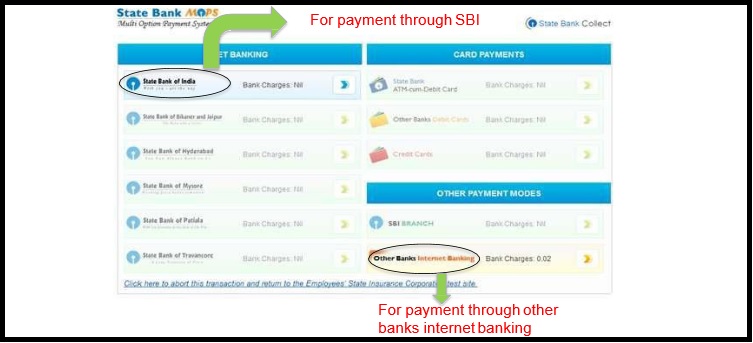

Step-6 : Select your bank from drop down and you will be redirected to corresponding Bank gateway

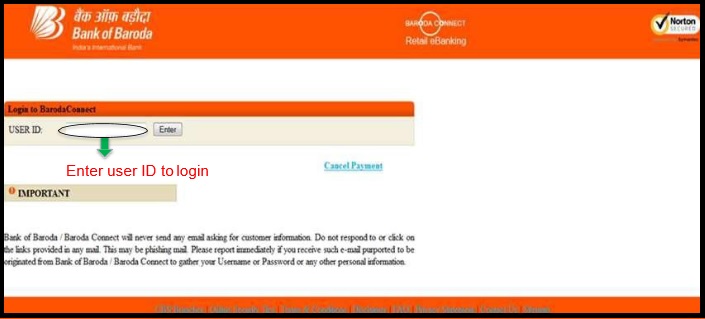

Step-7 : Enter user ID to login

Step-8 : Enter credentials to proceed to payment.

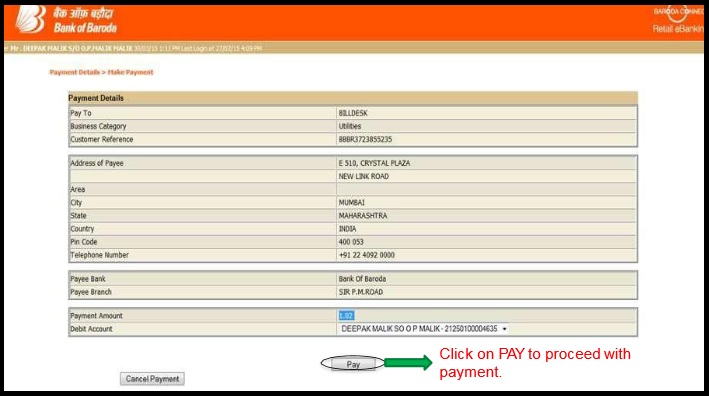

Step-9 : Click on PAY to proceed with payment.

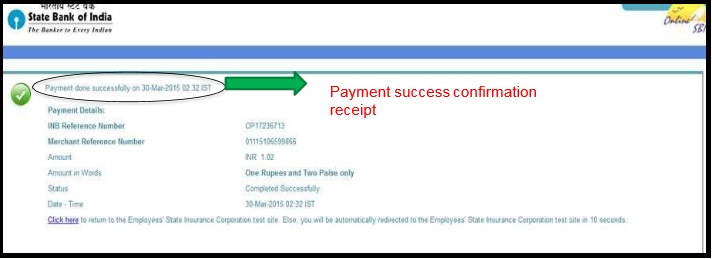

Step-10 : Challan Payment success confirmation receipt

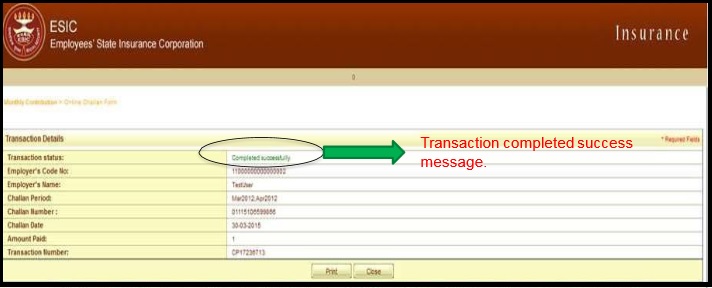

Step-11 : ESIC Transaction completed success message.

What is ESI Contribution?

1. ESI. Scheme being contributory in nature, all the employees in the factories or establishments to which the Act applies shall be insured in a manner provided by the Act.

2. The contribution payable to the Corporation in respect of an employee shall comprise of employer’s contribution and employee’s contribution at a specified rate. The rates are revised from time to time.

3. Currently, the employee’s contribution rate (w.e.f. 01.07.2019) is 0.75% of the wages and that of employer’s is 3.25% of the wages paid/payable in respect of the employees in every wage period.

4. Employees in receipt of a daily average wage upto Rs.137/- are exempted from payment of contribution. ESIC Employers will however contribute their own share in respect of these employees.

ESIC is also introduced an online facility to pay Challan (Monthly Contribution) online

ESIC Collection of Contribution

1. An employer is liable to pay his contribution in respect of every ESIC employee and deduct employees contribution from wages bill and shall pay these contributions at the above specified rates to the Corporation within 15 days of the last day of the Calendar month in which the contributions fall due.

2. The Corporation has authorized designated branches of the State Bank of India and some other banks to receive the payments on its behalf. Now you can pay the Challan (Monthly Contribution) online.

ESIC Contribution Period and Benefit Period:

There are two contribution periods each of six months duration and two corresponding benefit periods also of six months duration as under.

ESIC Contribution period Corresponding Cash Benefit period :

Contribution Period – Cash Benefit Period

1st April to 30th September- 1st Jan of the following year to 30th June

1st Oct to 31st March of the year following – 1st July to 31st December.

FAQ On ESIC Challan Payment

Frequently Asked Questions FAQ On ESIC Challan Payment

What is ESIC challan payment?

ESIC challan payment is the process of paying the Employees’ State Insurance Corporation (ESIC) contributions online.

What is ESIC?

The Employees’ State Insurance Corporation (ESIC) is a statutory body that provides social security and health insurance benefits to employees in India.

Who is required to pay ESIC contributions?

Employers with 10 or more employees are required to register with ESIC and make monthly contributions on behalf of their employees.

How can I make ESIC challan payment?

ESIC challan payment can be made online through the ESIC portal using net banking, debit card, or credit card.

Is it mandatory to make ESIC payments online?

Yes, it is mandatory to make ESIC payments online.