propertytax.py.gov.in : Pay Property Tax Online Puducherry

Organisation : Puducherry Local Administration Department

Service Name : Pay Property Tax Online (Property Tax Information System)

Applicable State/UT: Puducherry

Website : https://lgrams.py.gov.in/PropertyTax/PayTaxOnline

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

How To Pay Puducherry Property Tax Online?

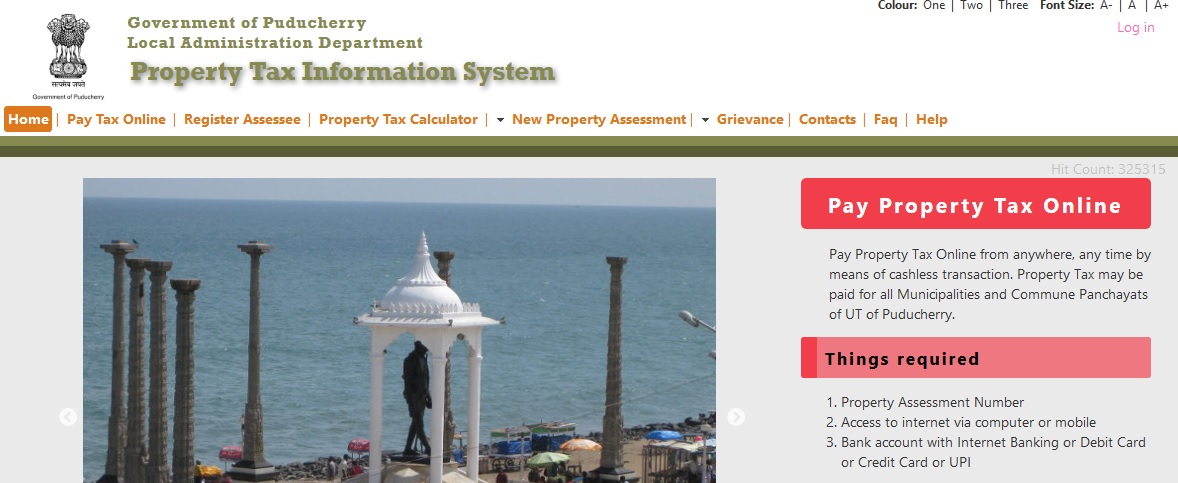

Pay Property Tax Online from anywhere, any time by means of cashless transaction. Property Tax may be paid for all Municipalities and Commune Panchayats of UT of Puducherry.

Related / Similar Facility : Puducherry Encumbrance Certificate Online

Things Required To Pay Puducherry Property Tax Online

** Property Assessment Number

** Access to internet via computer or mobile

** Bank account with Internet Banking or Debit Card or Credit Card or UPI

Steps:

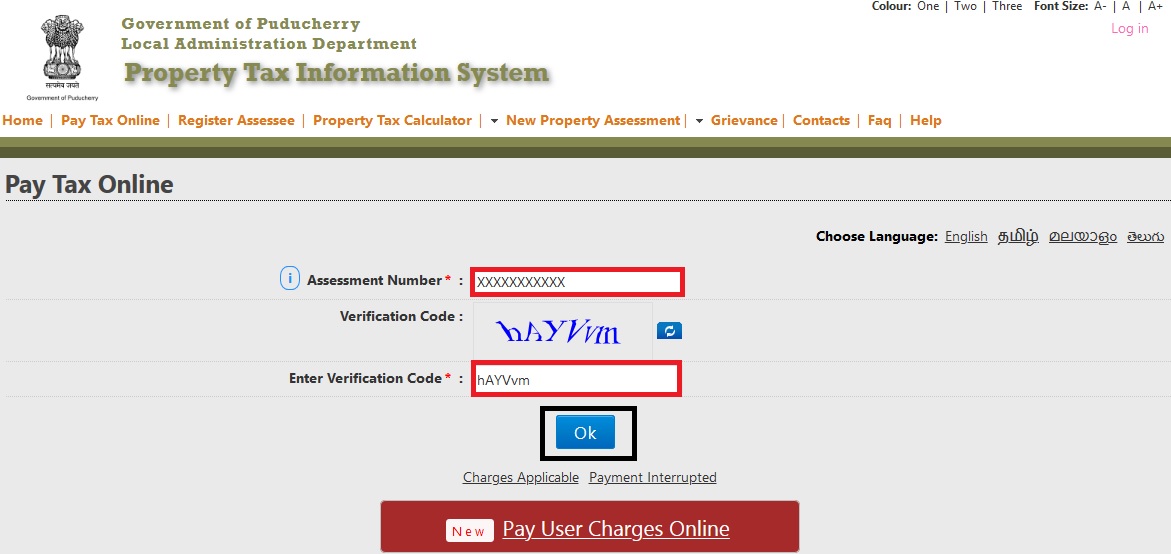

** Click here to go to online tax payment page

** Enter Assessment Number & Verification Code

** Click Ok

** Select number of terms to be paid

** Provide payer name and mobile number

** Click Ok

** Review the details and click Ok and wait for the bank site to load

** Make payment

** Download the receipt

Payment Mode of Puducherry Property Tax

Online/ Cashless:

** Credit Card

** Debit Card

** Debit Card + ATM Pin

** Internet Banking

** UPI

Collection Centre:

** Debit Card & Credit Card Via POS

** Cheque & Demand Draft

** Cash

Charges Applicable For Puducherry Property Tax Payment

The fees to be paid by citizen using online payment services of NDML for entity service shall be computed and paid as specified herein below

Internet Payment:

Rs. 5 for transaction amount up to Rs. 500.

Rs. 10 for transaction amount above Rs. 500.

Debit Card Payment:

0.75% of the transaction amount for value uptoRs. 2000

1% of transaction amount for transaction amount above Rs 2000

Credit Card Payment:

1.00% of the transaction amount.

Cash-card/Prepaid/Wallets:

Rs 10 or 1.5% of the transaction amount whichever is lower

IMPS:

** Rs. 5 for transaction amount up to Rs. 5000

** Rs. 7 for transaction amount from Rs. 5,001 to Rs 25,000

** Rs. 8 for transaction amount from Rs. 25,001 to Rs 50,000

** Rs. 9 for transaction amount from Rs. 50,001 to Rs 1,00,000

NEFT/ RTGS:

Rs 5 per payment for any transaction

Online Payment Interrupted?

** After 45 minutes, click here to know your payment status and download the receipt for successful payment by providing Assessment Number and payer mobile number (used while making transaction).

** Contact your Municipality / Commune Panchayat Revenue Officer.

FAQ On Puducherry Property Tax Payment

1. My online payment of property tax got interrupted and I am unable to make new payment also. What to do?

Your first payment attempt status needs to be updated before attempting for second time. You can try update the status after 45 minutes by following the link ‘Payment Interrupted?’ on the Pay Tax Online page by providing the reference number and assessment number. Cashiers of the concerned municipality may also update the status on next working day, if already not updated.

2. Online tax payment failed but account has been debited. What to do?

In few cases this may happen like corporate account (maker/checker type) transactions. Please do not make another payment. After reconciliation with bank for such transactions, receipt downloading shall be enabled within 5 working days (intimated by SMS). Download the receipt using ‘Payment Interrupted?’ link available on ‘Pay Tax Online’ page.

3. Are there any charges applicable for online tax payment?

Yes. Please refer the URL – https://web.archive.org/web/20180205062509/http://lgrams.puducherry.gov.in:80/charges-applicable

4. While attempting to login after four months of inactivity, I am getting message ‘Your user account is not approved or deactivated’. How do I login again?

Assessee may use forgot password option to activate account. Department users may contact department head.

I am unable to go online to pay property tax when click the link. Is there any other link that we can use and login and pay the amount?