incometaxindiaefiling.gov.in e-Verify Return : Income Tax Department

Organisation : Income Tax Department

Facility : e-Verify Return

Applicable For : All India

Website : https://www.incometax.gov.in/iec/foportal

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

Income Tax eFiling e-Verify Return

Kindly follow the below steps to e-Verify your Return ,

Related / Similar Facility : Income Tax e-PAN Application

How to e-Verify Return?

Steps :

Step 1 : Visit the official website of Income Tax Department through provided above.

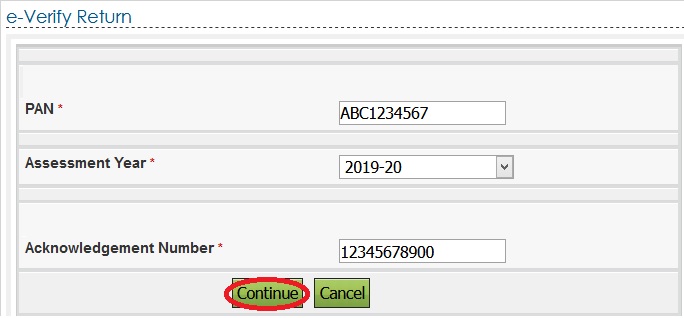

Step 2 : Next, Enter Your PAN Number

Step 3 : Select your Assessment Year from the dropdown

Step 4 : Enter Your Acknowledgement Number as in ITR-V

Step 5 : Finally click on “Continue” button

Note :

1. This facility is available for

** returns filed for Assessment year 2019-20 and onwards and

** returns where digital signature certificate is non mandatory and

** returns not filed by authorised signatory or representative assesse

2. Authorised signatory and Representative assesse are required to e-verify the return post login to e-Filing at their respective capacity

Other Methods for e-Verify Return

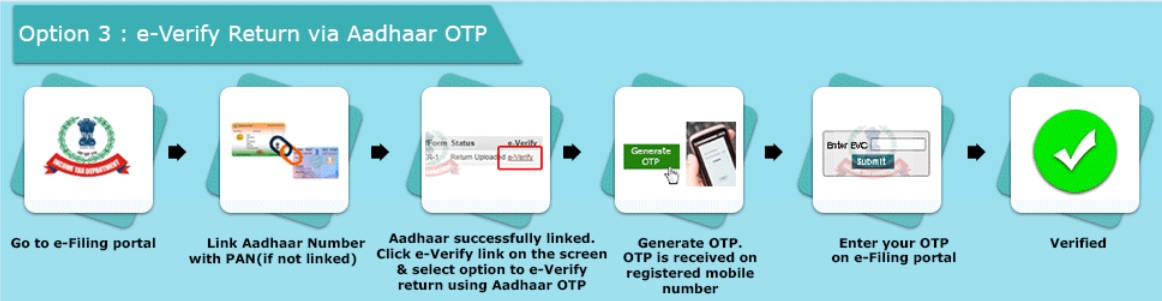

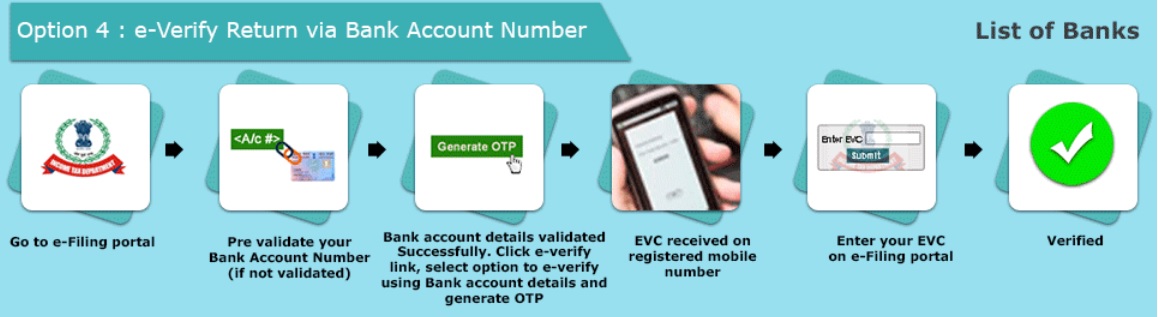

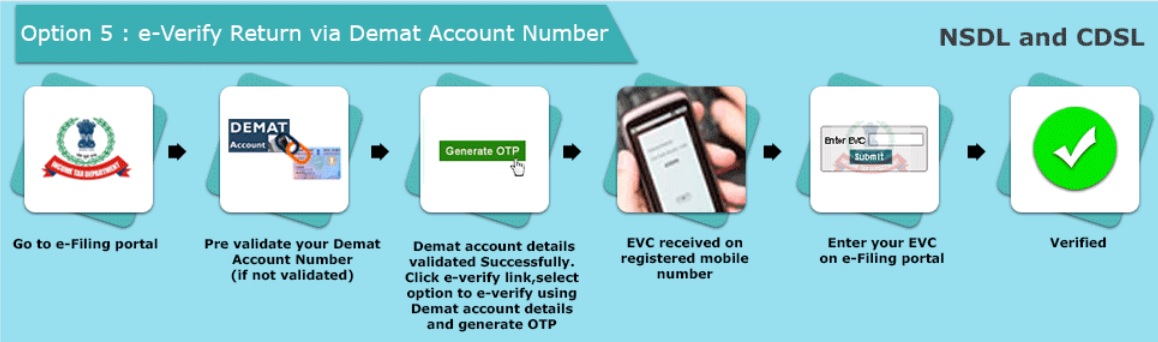

e-Verify your Return using Aadhaar OTP, Net Banking, Pre-Validated Bank Account and Pre-Validated Demat Account.

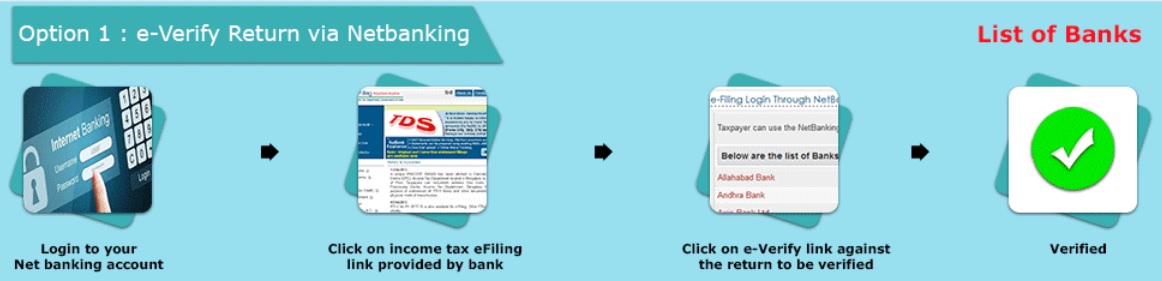

Netbanking

List of Banks :

** Allahabad Bank

** Andhra Bank

** Axis Bank Ltd

** Bank of Baroda

** Bank of India

** Bank of Maharashtra

** Canara Bank

** Central Bank of India

** City Union Bank Ltd

** Corporation Bank

** DCB Bank Limited

** Dena Bank

** Equitas Small Finance Bank Ltd

** HDFC Bank

** ICICI Bank

** IDBI Bank

** Indian Bank

** Indian Overseas Bank

** IndusInd Bank Ltd

** Jammu & Kashmir Bank

** Karnataka Bank

** Kotak Mahindra Bank

** Oriental Bank of Commerce

** Punjab National Bank

** Punjab and Sind Bank

** South Indian Bank

** State Bank of India

** Syndicate Bank

** The Federal Bank Limited

** The Karur Vysya Bank Ltd

** UCO Bank

** Union Bank of India

** United Bank of India

** Vijaya Bank

** Yes Bank Ltd

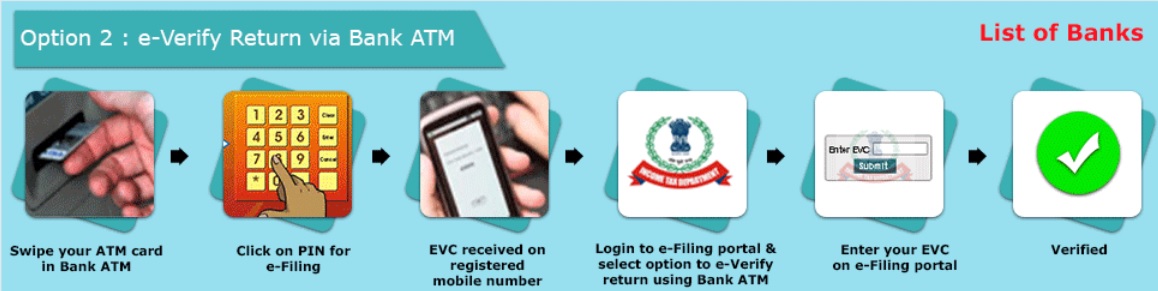

Bank ATM

List of Banks :

** Axis Bank Ltd

** Canara Bank

** Central Bank of India

** ICICI Bank

** IDBI Bank

** Kotak Mahindra Bank

** State Bank of India

Aadhaar OTP

Bank Account Number

List of Banks :

** Allahabad Bank

** Andhra Bank

** Bank of Baroda

** Canara Bank

** Central Bank of India

** City Union Bank

** Federal Bank

** HDFC Bank

** ICICI Bank

** IDBI Bank

** Karur Vysya Bank

** Kotak Mahindra Bank

** Oriental Bank of Commerce

** Punjab National Bank

** Saraswat Bank

** South Indian Bank

** State Bank of India

** Syndicate Bank

** UCO Bank

** Union Bank of India

** United Bank of India

Demat Account Number

FAQs

1. Invalid Aadhaar OTP while entering to e-verify the income tax return?

You are requested to retry after sometime by generating the fresh Aadhaar OTP and proceed further. Or Kindly contact the UIDAI Helpdesk at 1947 for Aadhaar OTP related issues.

Alternatively, you may e-Verify the income tax return through options given below,

** Login to e-Filing through Net Banking

** EVC through pre-validating Bank Account

** EVC through pre-validating Demat Account

** EVC through Bank ATM

2. I have made the tax payments successfully and still the pending tax is showing in Tax Paid Verification sheet?

You are requested to enter the e-Pay tax payment details (BSR Code, Challan Details etc) manually while filing the income tax return in ‘Tax Details’ sheet under ‘Sch IT – Details of Advance tax and self-assessment tax payments’ and proceed further.

3. Unable to Link Aadhaar with PAN due to profile mismatch and unable to file the income tax return?

The mentioning the valid 12 digit Aadhaar number/ 28 digit Enrolment ID [for those who are yet to get Aadhaar but enrolled] in the ITR form is made mandatory for filing of returns.

** If you have obtained AADHAAR then kindly enter the 12digit AADHAAR number in the ITR.

** If you have not obtained AADHAAR then kindly enter the 28 digit Enrolment ID in the ITR.