Renewal of VAT/CST Registration : Commercial Taxes Department Puducherry

Organization : Commercial Taxes Department Puducherry

Facility : Renewal of VAT/CST Registration

Home Page : http://gst.puducherry.gov.in/

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

How To Renew Puducherry VAT Registration?

The Commercial Taxes Department has already introduced online renewal of registration under the Puducherry Value Added Tax Act, 2007 during the last financial year. Renewal for the current financial year 2012-13 can also been done in the same manner.

Related / Similar Service : GST Puducherry Issue F-Form Online

where you have to enter the following details :

** By default your TIN No., Name and Address will be displayed, you cannot make any correction in these Columns, except the PIN code.

** PAN No. of the dealer available in the office record will be shown here. Dealers can edit the PAN No., if required.

Here the PAN No. has to be entered / corrected as below :

** Proprietorship – PAN No. of the Proprietor / Proprietorix

** Partnership – PAN No. of the firm

** Limited Company – PAN No. of the Company

** Constitution of the business as per our office record is displayed. The dealer will not be able to make any corrections here.

kindly provide the following details relating to the business :

** Phone No. 2. Mobile No. 3. Fax No. & E-mail I.D.

** Provide the name and designation of the contact person.

** Next, if you are manufacturer put a tick mark against ‘Manufacturer’ and also select the relevant category viz., Micro, Small, Medium, Large and others. Now, enter the SSI/MSI/LSI register No. and date, Date of commencement of production as per the certificate issued by the Directorate of Industries.

** Next, type the name of the goods manufactured, separated by comma for each goods.

** Next, if you are trader put a tick mark against it and select a category from Wholesaler / Retailer / Distributor / others.

** Next, select the name of the goods dealt by you from the dropdownlist. If the commodity dealt by you is not in the list, select others andthen type the name of the goods separated by comma. After selecting / typing the commodity, click button to add in the list.

** Now the data will be transferred to the Departmental Server and you can take a printout. The Competent and Authorised person has to write his name, sign by affixing the seal of the business, write the place and date, attach the cheque/DD and submit it in the respective office, there you will get a receipt. That’s all. You have renewed.

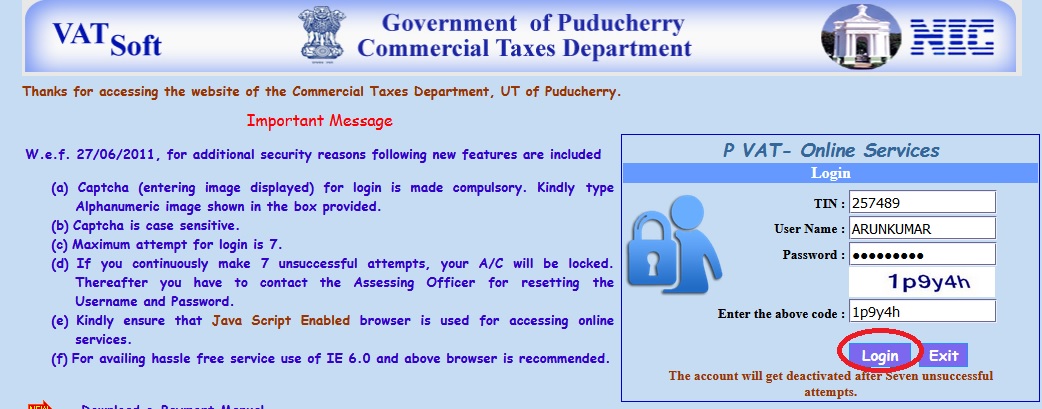

Important Message :

W.e.f. 27/06/2011, for additional security reasons following new features are included

(a) Captcha (entering image displayed) for login is made compulsory. Kindly type Alphanumeric image shown in the box provided.

(b) Captcha is case sensitive.

(c) Maximum attempt for login is 7.

(d) If you continuously make 7 unsuccessful attempts, your A/C will be locked. Thereafter you have to contact the Assessing Officer for resetting the Username and Password.

(e) Kindly ensure that Java Script Enabled browser is used for accessing online services.

(f) For availing hassle free service use of IE 6.0 and above browser is recommended

About Us :

To efficiently mobilize revenue (taxes) under the VAT and CST Acts at minimum cost to the exchequer and by providing the maximum level of convenience to the tax payers.

To promote compliance with the Value Added Tax Law and Central Sales Tax Law by simplification of processes and procedures, by disseminating the requisite knowledge and information to the tax payers at their door step by leveraging information, communication technology.

Benefits of Puducherry VAT Registration

There are a number of benefits to registering for Puducherry VAT, including:

** You can claim input tax credit on the goods and services you purchase for your business.

** You will be able to issue VAT invoices to your customers.

** You will be able to file VAT returns and pay VAT on time.

** You will be able to avail of the various benefits and concessions that are available to registered VAT taxpayers.

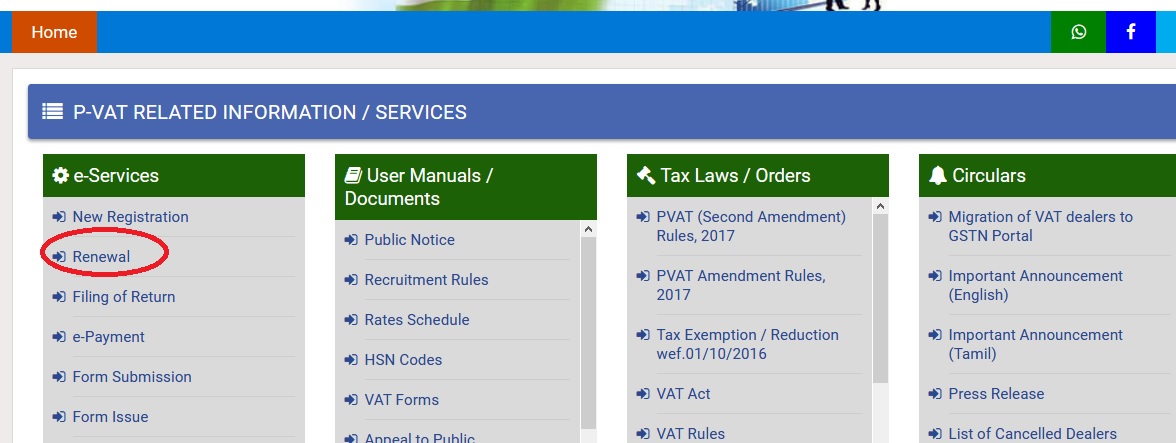

HOW TO DO ONLINE RENEWAL FOR TIN & CST?