psdt.punjab.gov.in : State Development Tax Portal Registration

Organisation : Punjab State Development Tax Portal

Facility Name : PSDT Registration

Applicable State/UT : Punjab

Website : https://psdt.punjab.gov.in/

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

PSDT Registration

Punjab State Development Tax Portal, PSDT Registration

How To Register?

Steps to navigate through Single Window Portal to apply for Registration under Profession Tax.

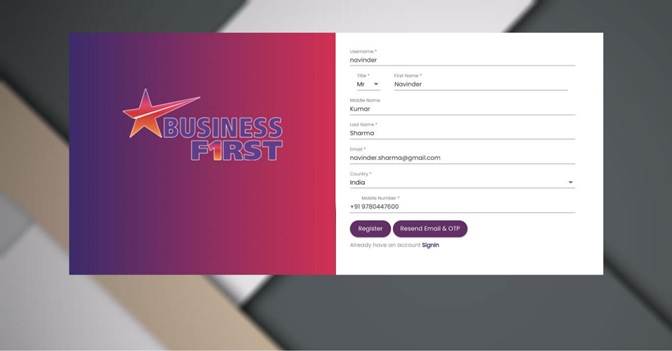

1. The investor needs to fill details like Username, First Name, Middle Name (optional), Last Name, Email, Country , Mobile No. and click Register button

2. The system will send a confirmation email and mobile OTP to email and mobile provided with above form. It will display screen, click Ok button

3. Click on Click Here button for Email Verification

4. In, Email confirmation message, click Ok button

5. In next step, the system will ask for Mobile OTP (sent on provided Mobile No.), enter Mobile OTP and click Verify Mobile No. button:

6. Mobile No. will be confirmed, click Ok button

7. At next step, investor can set his password by entering New Password, Confirm Password and clicking Set Password button:

8. This will complete Investor Registration process

9. User login after successfully registered at web portal

10. Click on Apply for New Services

11. After Click on New button New Service Profile Page Open

12. After submit Service Profile Page Dashboard Page is Open. Click on Details

13. After click on details. Click on Apply for New Clearance, then list of forms is open

14. Search for registration of profession tax as shown below and press New. Please make sure before click on New Button that you have applied for “Organization” or an “Individual” :

15 . Fill the required details and press save and lock. (Note: Please make sure you have applied for Organization or an Individual)

16. Press yes on the pop-up screen to save the details. It will complete the registration process.

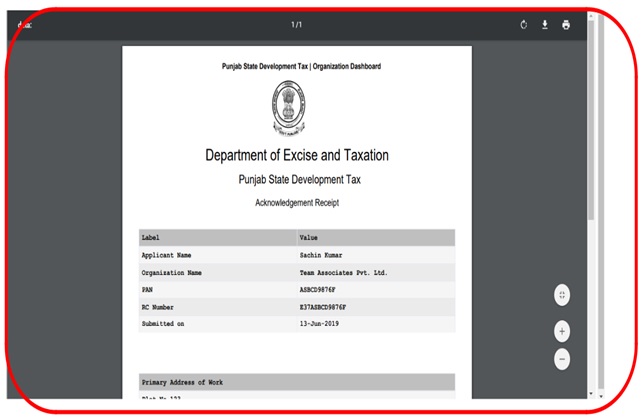

17. Users can download the certificate by pressing Download Clearance

18. Users see the below clearance on downloading.

Frequently Asked Questions (FAQ’s)

1. Who is liable to pay tax under this Act?

Any person engaged in trade, calling, profession or employment, who is a income tax payee, means whose taxable income under Income Tax Act, 1961 is more than ‘0’ shall be liable to pay tax under Punjab State Development Tax Act, 2018.

2. What do you mean by income tax payee?

Income tax payee means the person whose net taxable income exceeds the basic exemption/ threshold limit prescribed under Income Tax Act, 1961. Net taxable income shall be calculated after deducting all the permissible exemptions and deductions under Income Tax Act, 1961. Illustration- Mr. A has gross income of Rs. 700000. The permissible deductions are Rs. 100000. His taxable income is Rs. 600000 after deductions. He is liable to pay income tax and tax under Punjab State Development Tax Act, 2018.

3. Who is exempted from paying tax under Punjab State Development TaxAct, 2018?

1. All people who earn wages on casual basis.

2. All people involved in agriculture who sell their agricultural produce exclusively within the state of Punjab.

4. Are senior citizens exempted from paying tax under Punjab State Development Tax Act, 2018?

As per section 4(2) of the act ” Senior citizens shall, however, be exempted as per the Income Tax Act, 1961.”

It shall be noted that senior citizens, persons above the age of 60 years, are not exempted from paying income tax under Income Tax Act, 1961. They have been granted higher exemption limit as compared to normal tax payers.

Thus, they shall be liable to pay tax under Punjab State Development Tax Act, 2018, if their net taxable income exceeds the threshold limit prescribed for senior citizens. Illustration- Mr. A, age 66 years, has gross income of Rs. 500000.

The permissible deductions are Rs. 150000. His taxable income is Rs. 350000 after deductions. Threshold limit in case of senior citizens is Rs. 300000. He is liable to pay income tax and tax under Punjab State Development Tax Act, 2018

Contact & Support

For queries contact us @ psdt[dot]helpdesk[at]gmail[dot]com

Helpline Number: 0175-2225192, 0175-2300419