Axis Mutual Fund Account Statement Download : axismf.com

Organisation : Axis Mutual Fund

Facility Name : Download Mutual Fund Account Statement

Applicable For : Axis MF Account Holders

Website : https://www.axismf.com/

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

What is a Mutual Fund?

A mutual fund is a pool of professionally managed funds where fund houses / Asset Management Companies (AMCs) collect money from investors sharing a common investment objective and invest this pool of funds across the Indian economy. Depending on the mutual fund’s risk profile and investment objective, the money is invested across multiple money market instruments including equity, debt, corporate bonds, call money, government securities, etc.

Related / Similar Facility : Axis Mutual Fund WhatsApp Service

What is an Account Statement?

An account statement reflects your holding in your scheme. An account statement will reflect the following:

** Scheme you have invested in

** The amount you invested, the purchase price and the units you were allotted

** Other details like Bank details, mailing and contact details, nominee details etc.

The industry issues a consolidated account statement across fund houses once a month. However one is free to request for an account statement with each fund house that will reflect just holdings in the schemes managed by that fund house. There are charges levied for requesting an account statement.

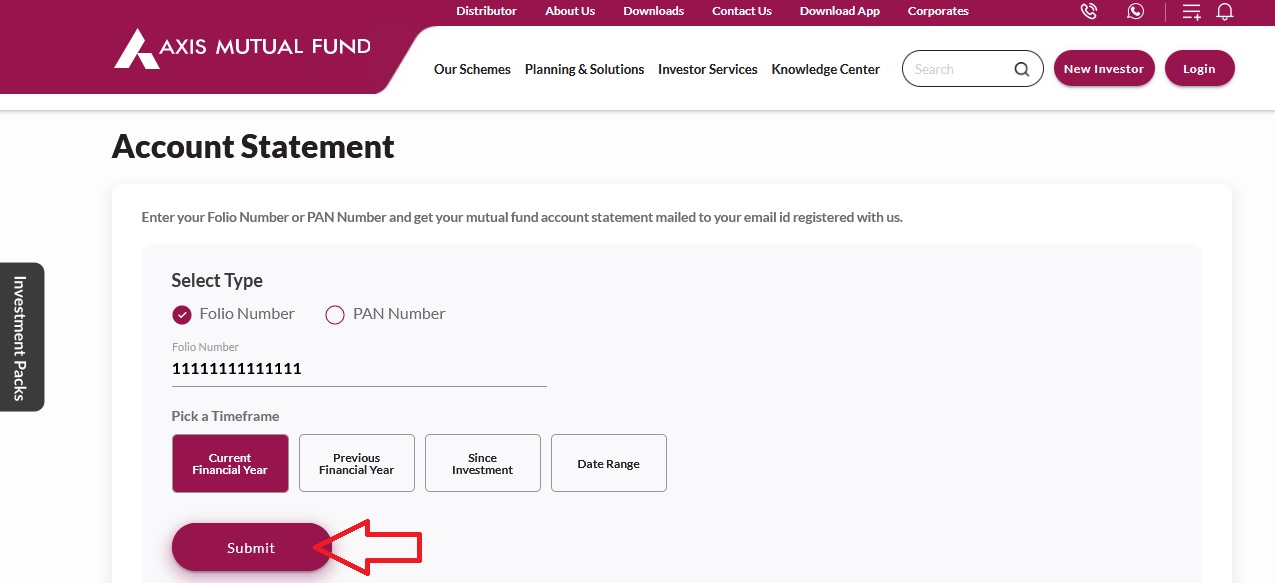

How To Download Mutual Fund Account Statement?

To Download Mutual Fund Account Statement, Just follow the below steps

Steps:

Step-1: Go to the link https://www.axismf.com/

Step-2: Enter your Folio Number or PAN Number and get your mutual fund account statement mailed to your email id registered with us.

FAQ On Axis Mutual Funds

Frequently Asked Questions FAQs On Axis Bank Mutual Funds

What is EasySMS 9212010033?

Axis Mutual Fund’s EasySMS is a unique service that allows you to:

** Buy or sell units of Axis Mutual Fund by simply sending an SMS

** Transact without any PINs or passwords

** Saves time and effort by eliminating the need to fill out lengthy forms each time you wish to transact

** Saves the trouble of travelling to a transaction Centre to submit your application

Who can access this service?

All existing investors having WhatsApp on their registered mobile number. The investor can initiate the conversation by sending us a ‘Hi” on WhatsApp from their registered mobile number.

What is a folio number?

A Folio number like a bank account number depict yours holdings in schemes of the fund house. There is no restriction on the number of folios that one can have with a fund house. However it is good housekeeping to have a minimal number of folios as it eases the task of tracking your investments.

What is KYC?

KYC is a one-time exercise while dealing in securities markets – once KYC is done through a SEBI registered intermediary (broker, DP, Mutual Fund etc), you need not undergo the same process again when you approach another intermediary.All Mutual funds under the aegis of the Association of Mutual Funds of India (AMFI) have facilitated a centralized platform through CVL,NDML,DotEx, CAMS & KARVY to carry out the KYC procedure on their behalf.Thus once you are successfully registered with CVL, NDML, DotEx, CAMS & KARVY, you can invest in any Mutual Fund in India. There is no separate number that is allotted on your successful registration. Your Permanent Account Number (PAN) is the unique identifier.

What is SIP Switch and what are the benefits?

SIP Switch is a facility that will allow investors to continue with their SIP installments under the same mandate on a different scheme. E.g. Investor has an SIP in Axis Long Term Equity Fund for Rs 1000 started in Jan 2015 and ending in December 2018. Investor submits a SIP switch in June 2016 and switch date is July 2016. Switch-In Scheme is Axis Equity Fund. The remaining installments, till Dec 2018, will be invested in Axis Equity Fund effective July 2016. Investor does not have to fill multiple forms such as cancel the existing SIP and register a new SIP. Reduces paperwork and efforts.

Who can avail the iSIP facility?

An existing individual investor can register SIP online. Investor need to have Net banking with utility payment facility enabled with bank registered in the folio.

What is EasyInvest?

EasyInvest is a service offered by Axis Mutual Fund to enable you to perform financial transactions anytime/anywhere. It helps you Purchase, Redeem or Switch units of Axis Mutual Fund schemes using the internet. Apart from these, you can also view your account and transaction details and view/download your account statements online.

What is Systematic Investment Plan (SIP)?

A systematic investment plan (SIP) is one of the ways to invest in mutual funds. An investor opts for SIP when he wants to invest a specific amount in a mutual fund at regular intervals. In SIP, a specific amount is debited from the investor’s savings account electronically transferred to the mutual fund. SIPs allow investors to benefit from rupee cost averaging and one does not need a large capital for an initial investment in mutual funds.

How to register for Systematic Transfer Plan (STP) online?

All existing investors can login to www.axismf.com website and login to the view the portfolio and register for STP online.

What services are available on WhatsApp?

Currently below services are available:

** NAV

** Valuation

** Account statement

** Purchase Status

** Redemption Status

** Logging a complaint/query/request

** Transactions

To transact online, is folio association mandatory?

Yes, for the post login.

Features of Axis Mutual Fund

Here are some of the features of Axis Mutual Fund:

** Investments across asset classes: Axis Mutual Fund offers a wide range of investment options across asset classes, including equity funds, debt funds, hybrid funds, and liquid funds. This allows investors to choose the right investment option for their risk appetite and investment goals.

** Experienced fund managers: Axis Mutual Fund has a team of experienced fund managers who have a proven track record of managing investments. This gives investors confidence that their money is in good hands.

** Transparent and easy-to-use investment process: Axis Mutual Fund has a transparent and easy-to-use investment process. Investors can open a mutual fund account online or offline and start investing in a matter of minutes.

** Low expense ratios: Axis Mutual Fund has low expense ratios, which means that investors keep more of their investment returns.

** Customer support: Axis Mutual Fund offers excellent customer support. Investors can contact Axis Mutual Fund by phone, email, or chat for assistance with their investments.

Complicated

Many other MFs have simpler ways to provide statement