karuvoolam.tn.gov.in : E-Challan Creation/Payment Tamil Nadu

Organisation : Tamil Nadu Department of Treasuries and Accounts

Facility Name : E-Challan Creation/Payment

Applicable State/UT : Tamil Nadu

Website : https://www.karuvoolam.tn.gov.in/

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

How To Create E-Challan?

e-Challan has been enabled now. For users who created offline and online mode, e-Challan through Bank of Baroda, SBI, IOB and Indian Bank Payment Gateway on 15th December, new challan number has been sent to the registered mobile number used in e-challan. Users are requested to take print out of e-Challan with new Challan number before presenting it to bank / department for challan acknowledgment.

Related / Similar Facility :

Steps:

Follow the below steps to create E-Challan

Step-1 : Go to the link https://www.karuvoolam.tn.gov.in/challan/echallan

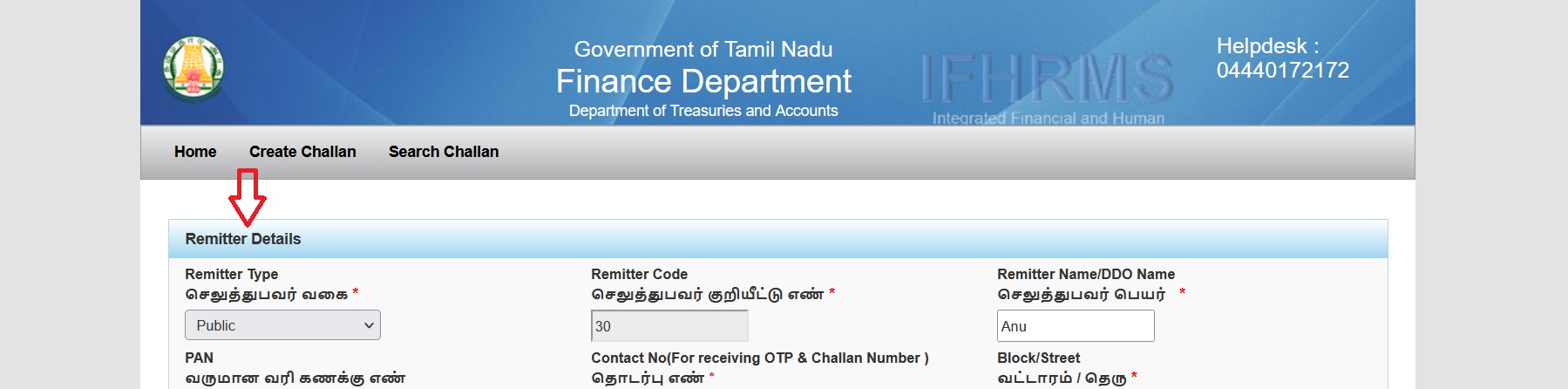

Step-2 : Enter the Remitter Details

Step-3 : Enter the Period Details

Step-4 : Enter the OTP Details

Step-5 : Enter the Service Details

Step-6 : Enter the Payment Details and

Step-7 : Click on Submit button

Note:

You will receive an One Time Password (OTP) on the above mentioned Mobile Number, Enter the OTP and click on Continue

FAQ On Tamil Nadu Treasuries

Frequently Asked Questions FAQ On Tamil Nadu Department of Treasuries and Accounts

1. How to transfer pension from one place to another ?

The pensioner has to submit an application to the Treasury Officer / Assistant Treasury Officer / Sub Treasury Officer concerned from where he/she gets monthly pension, giving the details of new address along with the original PPO.

The Assistant Treasury Officer/Sub Treasury Officer concerned will forward both halves to their respective Treasury Officer who in turn will forward the same to the Treasury Officer of the new address in respect of mofussal and Pension Pay Office Chennai-6 in respect of city. The Treasury Officer in the new station will forward both halves to the concerned Sub Treasury if the pensioners residence is at Taluk, under copy to the pensioner concerned.

On receipt of this reference the pensioner has to appear in the new office to get the first pension and the subsequent pension will be credited to the pensioner’s bank account. The process is likely to take minimum time of one month.

2. How to get family pension ?

Immediately on the death of the Pensioner the Treasury from where the pension is being received should be informed of the death in writing enclosing death certificate. (if available) If it is a joint PPO, the spouse should go over to the concerned Treasury in person submit an application to the Treasury Officer/Assistant Treasury Officer /Sub Treasury Officer for sanction of LTA/F.P along with form 14 (which is available in the Treasury) and after due verification and mustering, the Family Pension will be commenced from the next date of the death of the pensioner.

3. When will the Pension /Family Pension be stopped ?

a) If the Pensioner / Family Pensioner does not either appear in person for mustering or send , Life Certificate to the Treasury / Pension Pay Office anually.

b) If the pension is not drawn continuously for six months

c) If the Family Pensioner does not submit non-marriage / non-re-marriage/non-employment certificate every year.

Helpdesk

In case of any queries,clarifications, Please contact the below Email ID helpdesk AT karuvoolam.tn.gov.in

Call : 04440172172

Benefits of Tamil Nadu E-Challan

Here are the benefits of Tamil Nadu E-Challan:

** Transparency: E-challans are issued electronically, which makes the process more transparent. This means that violators can easily see what they were fined for and how much they owe.

** Accuracy: E-challans are generated by computers, which reduces the chances of human error. This means that violators can be sure that they are being fined for the correct offense and the correct amount.

** Efficiency: E-challans can be issued and paid for online, which saves time and effort for both the violator and the traffic police.

** Reduced corruption: E-challans can help to reduce corruption in the traffic police force. This is because there is no need for cash payments, which can be easily manipulated.

** Improved traffic safety: E-challans can help to improve traffic safety by deterring people from breaking the law. This is because violators know that they will be caught and fined if they break the law.

RTI Payment