wburbanservices.gov.in : Online Payment of Municipal Property Tax West Bengal

Organisation : West Bengal Department of Urban Development & Municipal Affairs

Facility Name : Online Payment of Municipal Property Tax

Applicable State/UT : West Bengal

Website : https://www.wburbanservices.gov.in/page/cms/property_tax_procedure_145131

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

How To Pay West Bengal Municipal Property Tax?

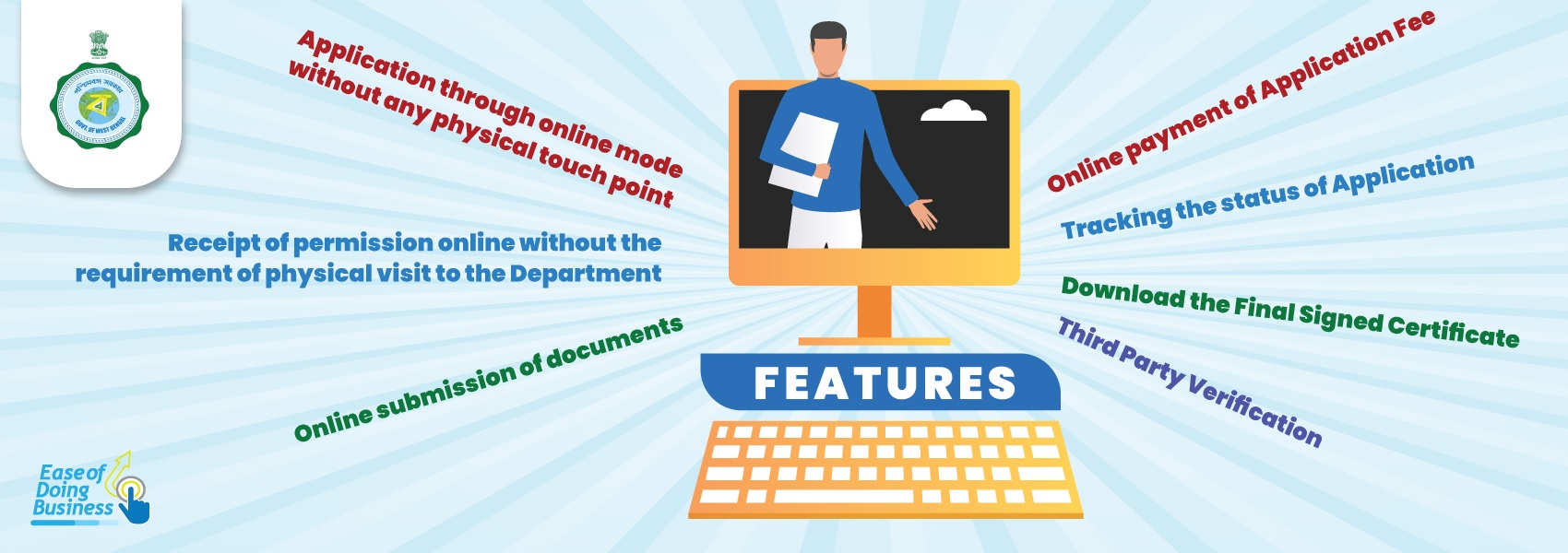

The need of providing various services in municipal areas through the on-line mode in view of easing business under active consideration of the State Government for some time and in view of above, Department of Urban development & Municipal Affairs has decided to introduce online payment of Municipal Property Tax in municipal areas through online mode without any physical touch point.

Related / Similar Facility : West Bengal Trade License Online Application

The online system has the following features without the requirement of physical visit to the West Bengal Department:

** Payment of Municipal PropertyTax.

** Track status of Dues of Property Tax.

Steps To Pay West Bengal Municipal Property Tax

To Pay West Bengal Municipal Property Tax online, follow the below steps

Step-1:

For Paying Property tax through Online Property Tax Information and Collection System (OPTICS) citizen has to type the URL “https://holdingtax.co.in” in the address bar of Web browser. Citizen has to click the link “Property Tax Payment (Citizen Entry)”.

Step-2:

Citizen has to click and Select the District, ULB, Ward, Location, Holding Number step by step from drop down menu and then will click to Proceed for Login.

Step-3:

After successful Assessee verification, a window will appear with Citizen Profile and Property Tax collection details with net payment Outstanding details financial year wise. Citizen can choose the quarter up to which he/ she wants to pay but he/she can’t pay for current financial year without clearing the previous financial year’s property tax due. Citizen can click to Proceed for paying the net payable amount.

Step-4:

After clicking Proceed, a pop up box will appear where the citizen has to enter his/ her mobile number (mandatory), Email ID(Optional) and has to choose the Payment Gateway available from the dropdown list. Then the citizen will click on Complete Payment tab. A pop up will appear for confirmation of the payment

Step-5:

After confirmation the Payment Gateway page will appear. Citizen can choose the preferable Payment option and enter payment details to make the payment.

Step-6:

After successful payment receipt will be available in the citizens’ login. Citizen can view the last 5 payment receipt in his/ her login.

Pay Tax Here : https://holdingtax.co.in/

Fees For West Bengal Municipal Property Tax Online Payment

West Bengal Municipal Property Tax Online Payment Fees

| Sl.No. | Name of the Subject Matter | Concerned Section of the Act | Rate of Taxes and Fees |

|---|---|---|---|

| 01. | Property Tax of land and building in Municipal Area | Section 96 of the West Bengal Municipal Act/Section 108 of the West Bengal Corporation Act | Maximum 30% of the annual value of the land and building |

Contact

Department of Urban Development & Municipal Affairs

Nagarayan, DF-8, Sector-I,

Salt Lake City, Kolkata-700064

Phone: +9133- 2334-9394

Email: secy[dot]ma-wb[at]gov[dot]in