Poonawalla Fincorp Online Mandate Cancellation Facility : ipg.poonawallafincorp.com

Organisation : Poonawalla Fincorp

Facility Name : Online Mandate Cancellation Facility

Applicable State/UT : All India

Website : https://poonawallafincorp.com/

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

How To Cancel Poonawalla Fincorp Mandate?

To cancel Poonawalla Fincorp Mandate online, Follow the below steps

Related / Similar Facility : Poonawalla Fincorp Online EMI Payment Facility

Steps:

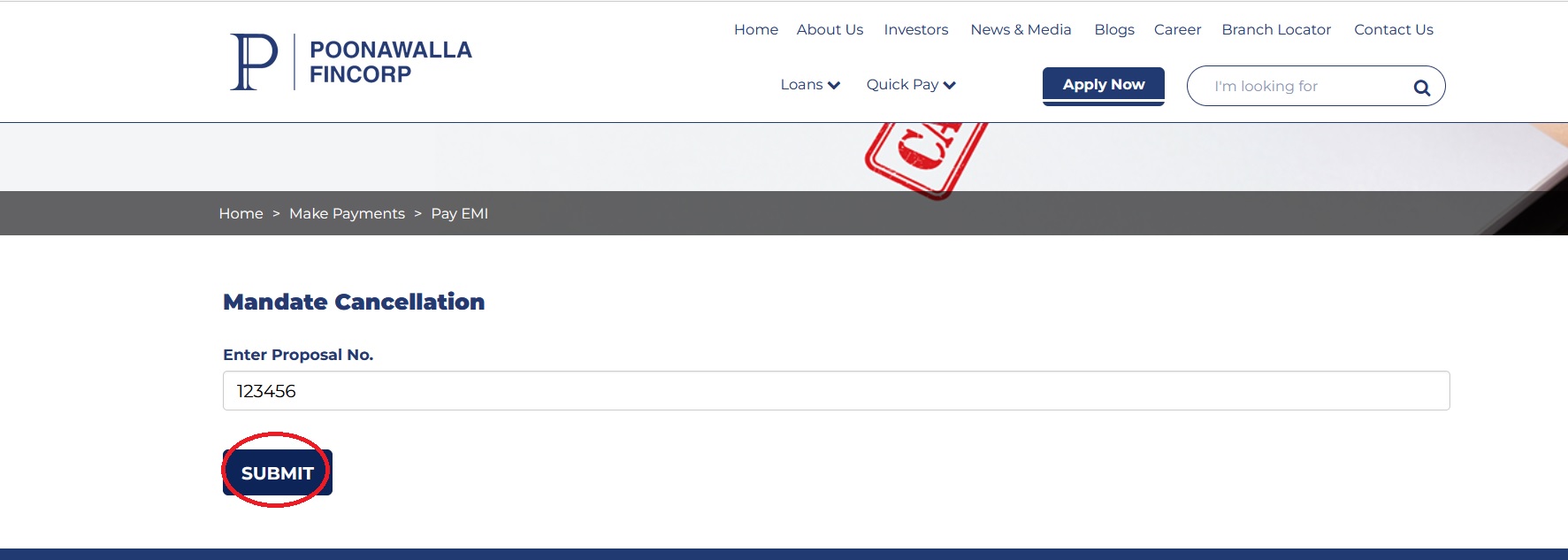

Step-1 : Go to the link https://ipg.poonawallafincorp.com/en/mandate-cancellation

Step-2 : Enter the Proposal Number

Step-3 : Click on the button “Submit”

FAQ On Poonawalla Fincorp

Frequently Asked Questions FAQ On Poonawalla Fincorp

What is the benefit offered under the resolution framework?

** The resolution plans may include rescheduling of payments, conversion of any interest accrued or to be accrued into another credit facility, granting of moratorium etc., based on assessment of income stream of the borrower, granting of additional credit facilities.

** Moratorium period, and/or extension of the residual tenor of the loan facilities may be for a maximum of two years and shall come into force immediately upon implementation of the resolution plan.

** Any other measures or modification in the existing terms of the loan, as the Company may deem appropriate, considering the financial situation of the Borrower and the feasibility of Restructuring.

Will the Company send any communication intimating the acceptance/rejection of the application for restructuring of the borrowers?

The Company will inform the borrower about confirmation/rejection through SMS/e-mail within 30 days from the date of application.

I had applied for restructuring facility under Resolution Framework 1.0. However, it was rejected by the Bank. Can I re-apply under Resolution Framework 2.0?

Yes, you can apply for restructuring facility under Resolution Framework 2.0.

Will restructuring have any impact in CIBIL reporting?

The credit bureau status of the restructured credit facilities availed by the borrower will be updated as “restructured due to COVID-19”.

I have availed Moratorium last year. Will I also get the benefit under this framework?

Yes, Borrowers who have availed Moratorium last year can also opt for resolution framework as per eligibility criteria.

What is the maximum period for which I can avail restructuring of my loan?

Proposed tenure extension to be of maximum 24 months from the existing contract tenure. This total extension of tenure will be inclusive of the tenure already availed of at the time of Resolution Framework 1.0. Restructuring terms will be decided case to case basis.

Contact

For support or any query, you can reach out to us on our toll-free number 1800-266-3201 or write at customercare [AT] poonawallafincorp.com