Poonawalla Fincorp Online EMI Payment Facility : ipg.poonawallafincorp.com

Organisation : Poonawalla Fincorp

Facility Name : Online EMI Payment Facility

Applicable State/UT : All India

Website : https://ipg.poonawallafincorp.com/en

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

How To Pay Poonawalla Fincorp EMI Online?

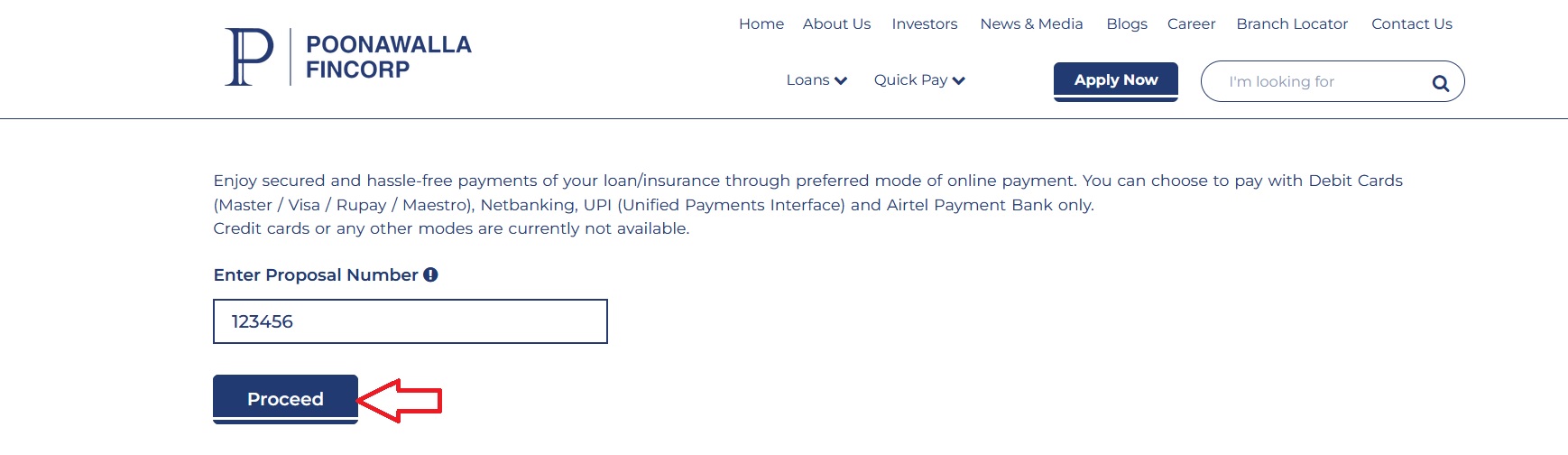

Enjoy secured and hassle-free payments of your loan/insurance through preferred mode of online payment. You can choose to pay with Debit Cards (Master / Visa / Rupay / Maestro), Netbanking, UPI (Unified Payments Interface) and Airtel Payment Bank only. Credit cards or any other modes are currently not available.

Related / Similar Facility : Poonawalla Fincorp Online Mandate Cancellation Facility

Steps:

Step-1 : Go to the above link

Step-2 : Enter Proposal Number

Step-3 : Verify Details

Step-4 : Receive Payment Confirmation

Note:

The transaction amount for UPI may vary from bank to bank between 10,000 and 1 Lakh per transfer. Please refer to the NPCI link http://www.npci.org.in/UPI_FAQs.aspx for any queries.

FAQ On Poonawalla Fincorp

Frequently Asked Questions FAQ On Poonawalla Fincorp

1. My existing loan is covered under CGTMSE scheme. What will happen in that case?

SME and LAP Products:

All restructured contracts except for CGTMSE covered contracts will be booked only after closure of the parent loan so that only one contract is live at any point of time against a particular asset; The re-structured contract will be tagged appropriately in Magma’s system to facilitate identification of such contracts in the portfolio.

ABF Products:

Fresh terms of the rehabilitated contract will be updated in the system. The re-structured contract will be tagged appropriately in Magma’s system to facilitate identification of such contracts in the portfolio. The loans covered under the CGTMSE will be not be closed in the system and shall be re-structured for the outstanding and overdue principal portions only and appropriately tagged in the system to identify such contracts.

2.What will be the loan amount of restructured loan?

SME and LAP Products:

Proposed Loan Amount will cover the principal outstanding, overdue EMI and/or unrecovered charges, if not already cleared, as may be decided by Magma. Proposed Loan Amount in case of CGS covered SME Business loan will cover the outstanding (including overdue principal amount). No interest component, other charges etc. to be added to the principal o/s to arrive at restructured amount under CGTMSE guaranteed accounts.

ABF Products:

Proposed Loan Amount will cover the principal outstanding, overdue EMI and/or unrecovered charges, if not already cleared, as may be negotiated with the customer. Proposed loan amount for contracts covered under CGTMSE scheme will cover the outstanding and overdue principal amount only. No interest component and other accrued charges, if any shall be added to the principal to arrive at the restructured loan amount under CGTMSE guaranteed contracts.

3. Will my interest rate also get reduced or increased under restructuring?

There shall not be any reduction in the interest rate. Yes, there may be an increase in the rate of interest depending on the Pricing Grid for restructured loans

Contact

For support or any query, you can reach out to us on our toll-free number 1800-266-3201 or write at customercare [AT] poonawallafincorp.com