TNRD VP Tax Demand Collection Receipt Online Tamil Nadu

Organisation : Tamil Nadu Rural Development & Panchayat Raj Department (TNRD)

Facility Name : View Demand Collection Receipt Online

Applicable State/UT : Tamilnadu

Website : https://vptax.tnrd.tn.gov.in/

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

How To View TNRD Demand Collection Receipt Online?

To View TNRD Demand Collection Receipt Online, Follow the below steps

Related / Similar Facility : TNRD Village Panchayat Property Tax Calculator Tamil Nadu

Steps:

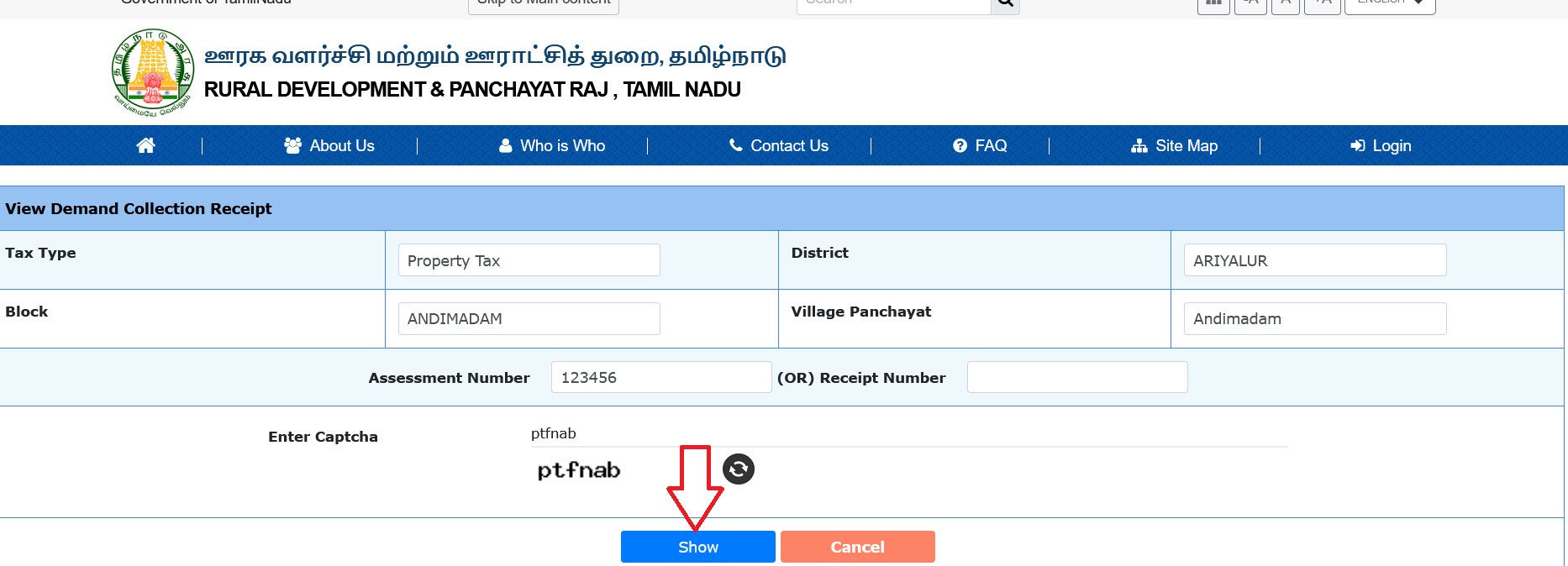

Step-1 : Go to the link https://vptax.tnrd.tn.gov.in/project/forms/VillagePanchayatMaster/Receipt_Bill_Details.php

Step-2 : Choose the Tax Type, District, Block, Village Panchayat

Step-3 : Enter the Assessment Number (or) Receipt Number

Step-4 : Enter the Captcha and

Step-5 : Click On Show Button

FAQ On TNRD Village Panchayat Tax

Frequently Asked Questions FAQ On TNRD Village Panchayat Tax

1. What is House Tax?

Tax is a tax levied by the Village panchayats for the buildings located in their jurisdictions. The term building includes all Buildings located in the Village Panchayats.

2. Who has to pay House Tax?

The owner/occupier of the buildings has to pay property tax to the concerned Village Panchayat.

3. How House tax is calculated for the property?

Property Tax is calculated based on the flat rate/ based on the build-up area of the property. The Tax calculator is enabled in the website for the further reference.

4. When Property should be assessed for House tax?

Property tax should be levied for the properties after the completion or occupation whichever is earlier, as per Section 172 of Tamil Nadu Panchayats Act 1994 and Tamil Nadu Village Panchayat (Assessment and Collection of taxes) Rules, 1999.

5. When property Tax should be paid?

The house tax shall and by the owner of the house within thirty days after the commencement of the half year or sixty days after the commencement of the year according to the period of levy.

6. If the assessee has not paid the property tax within the stipulated period ?

Every Village Panchayat may collect an interest for the belated payment of tax due to it at Rupees one and fifty paise or two rupees as may be decided by the Village Panchayat concerned for every hundred rupees of the tax for every month of belated payment.

The interest shall be levied after thirty days of the commencement of the year if the tax is levied on half – yearly basis or sixty days of the commencement of the year if the tax is levied on yearly basis.

7. Who is the bill collector for property tax and other Tax Revenues in rural areas ?

Village Panchayat Secretary is the responsible person for collection of Taxes.

8. Is any receipt will be given to the tax payer while paying Property Tax?

Yes. It will be given by the Village Panchayat Secretary directly downloaded from Tnrd website. There is a provision available for the citizen to avail the receipt from tnrd portal directly login in to the customer login.