TNRD Village Panchayat Property Tax Calculator Tamil Nadu

Organisation : Tamil Nadu Rural Development & Panchayat Raj Department (TNRD)

Facility Name : Property Tax Calculator

Applicable State/UT : Tamilnadu

Website : https://vptax.tnrd.tn.gov.in/

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

How To Calculate Village Panchayat Property Tax in Tamil Nadu?

To Calculate Village Panchayat Property Tax in Tamil Nadu, Follow the below steps

Related / Similar Facility : TNRD VPTax Demand Collection Receipt Online Tamil Nadu

Steps:

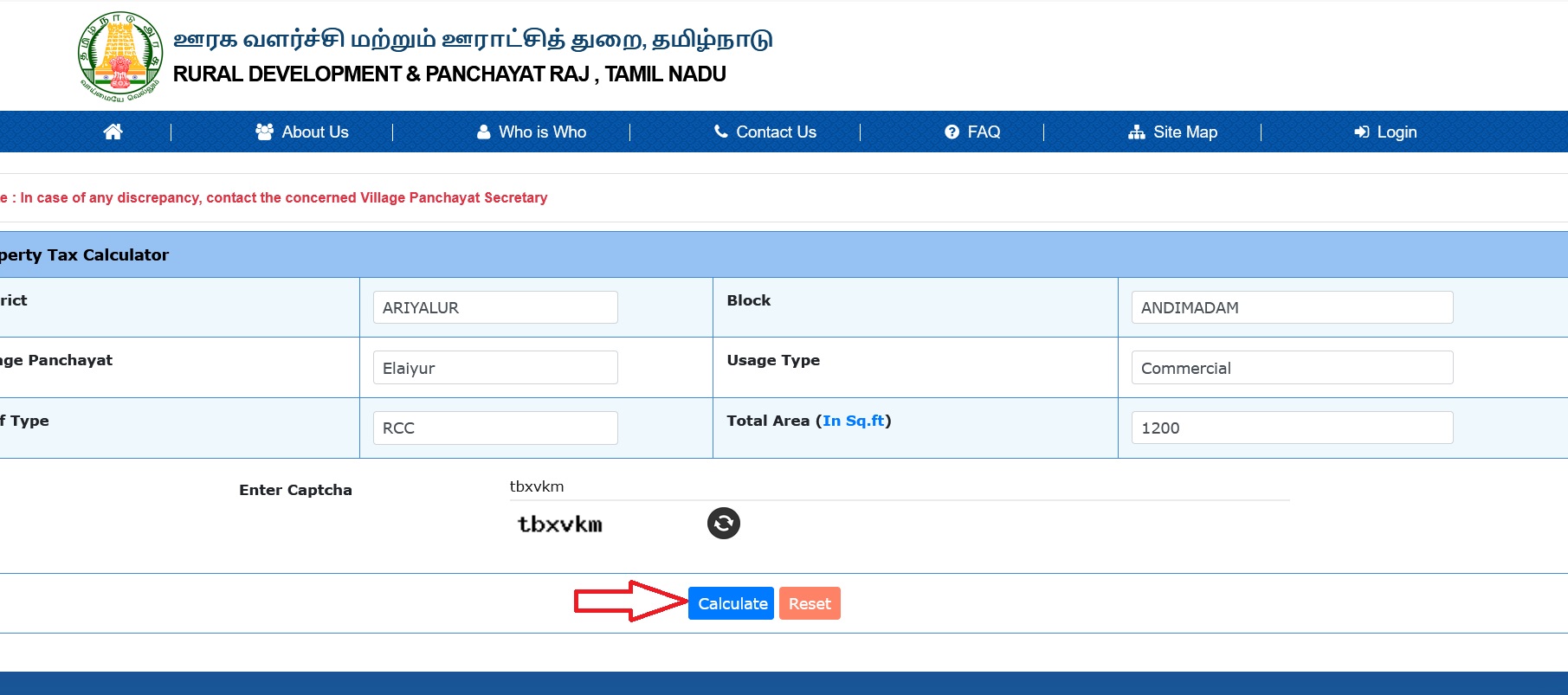

Step-1 : Go to the link https://vptax.tnrd.tn.gov.in/project/forms/PropertyTax/PropertyTaxCalculator_public.php

Step-2 : Select the District, Block, Village Panchayat, Usage Type, Roof Type

Step-3 : Enter the Total Area (In Sq.ft)

Step-4 : Enter the Captcha

Step-5 : Click On “Calculate” Button

Note :

In case of any discrepancy, contact the concerned Village Panchayat Secretary

FAQ On TNRD Village Panchayat Tax

Frequently Asked Questions FAQ On TNRD Village Panchayat Tax

1. What is Water Charges?

Water Charge is imposed by the Village Panchayats to those who have availed the Individual Household Tap Connection by the Village Panchayat.

2. Whether Water charges are collected for public fountain?

No. Water charges will be collected only from the thoseHouseholds who have availed Individual Household Tap Connection.

3. Is there any uniform rate is being levied by the Village Panchayatsfor water charges?

As per Government Order G.O.Ms.No. Rural Development and Panchayat Raj Dated: , there will be a rate of Rs. 30 per month prescribed as monthly water charges. But in certain cases, Village Panchayats by its resolution increases the water charges according to their administrative convenience.

4. Is it collected monthly or yearly basis ?

The water charges are being collected on half yearly or yearly basis. But the charges will be calculated on monthly basis.

5. What are all the modes of Payment available to pay the Taxes?

** Cash

** UPI (Unified Payments Interface)

** ATM card- Debit card Payment

** Credit Card payment

6. Whether any security deposit to be paid to avail new Water Supply connection to the Individual Households?

Yes. There will be a security deposit of Rs.1000 to be paid bythe citizen living in rural area to the Village Panchayat.

7. What is Professional Tax?

Tamil Nadu Panchayats Act empowers the Village Panchayats to levy tax on profession, Trade, Calling and Employment.

8. What are all the Provisions mentioned in Constitution of India on Professional Tax?

** Article 276 of the constitution empowers the State Legislature to enact act and rules that would govern levy and collection of Profession Tax.

** Article 276 also provides a ceiling amount to be collected from individuals. Government of India amended Article 276 in 1988 for revision of ceiling of Profession Tax from Rs.250/- to Rs.2500/- per annum.

9. What are all the provisions in respect of Professional Tax mentioned in Tamil Nadu Panchayat Act 1994.

** Based on Article 276(2) of Constitution of India, Government of Tamil Nadu have enacted and inserted provisions as section 198 B of Tamil Nadu Panchayat Act 1994 which empowers the Village Panchayats to levy tax on profession, Trade, Calling and Employment.

** Sub section (13) prescribed that the rate of tax shall be revised by the Village Panchayat once in every five years and such revision of tax shall be increased not less than twenty five percent and not more than thirty five percent of the tax levied immediately before the date of revision.

10. Whether any Rulesframed by the Government in respect of Professional Tax?

Yes. The Tamil Nadu Village Panchayats (Collection of Tax on Profession, Trade, Calling and Employment) Rules, 2000 is available.

11. Who is responsible for payment of Professional Tax?

It is the ultimate duty of the individual to payProfessional Tax to the Local Bodies who are all involved in Profession. But, the employer is vested with the responsibility to deduct the proportionate Professional Tax from the employee and the same appropriated to the Local Bodies.