Goa Excise Management System (GEMS)

Organisation : Department of Excise

Facility Name : Goa Excise Management System (GEMS)

Applicable State/UT : India

Website : https://excise.goa.gov.in/edealer/HomePage.aspx

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

What is Goa Excise Management System (GEMS)?

GEMS were aimed to achieve Good Governance and Paperless Office using ICT Tools. It was an initiative of Department of Excise, Government of Goa. The project includes a complete workflow web based G2B and G2G Application to provide end to end solution to the business community. This will help the department in better revenue collection, reduction in paper usage, minimize visit to the department by the business community and quick services delivery through Single Window electronic information exchange among stakeholders.

Related / Similar Facility : Goa File Management System (FMS)

Benefits of Goa Excise Management System (GEMS)

The system is available in 24×7

** Anywhere anytime services

** Dealer can submit all the application through online portal. Eliminate manual hand written application. The system will generate the application with GS1 barcode.

** All documents generated with GS1 barcode facilitate Unique Identification Number for each document and which can be verified across the Globe.

** Eliminate the files carrying and submitting physically. The dealer can scan and upload the entire reference document and the department official can view this document digitally. So the official can verify and take the decision without any fail. Thus saves manpower, Transport, Energy and paper.

** The application process which takes maximum 30 minutes to process any application submitted by the dealer. In manual process, the application process which takes minimum 3 working days to process any application submitted by the dealer.

** Saving papers result in reduction of cutting of trees and save the environment.

** Current application status through SMS and application tracking through portal.

** Generation of e-challan with appropriate head of Account and proceed for online payment gateway of SBI or payment at counter.

How To Register at Goa Excise Management System (GEMS)?

1. A Partnership Firm/Company or a Sole Proprietor who has completed 21 years of age and having 25 years Residence Certificate issued by the concerned Taluka Mamlatdar, Government of Goa, can apply for new licence, through the O/o. the Excise Inspector concerned Taluka..

2. Before trying to enter your data in the form please ensure that you have a passport size recent photograph and your signature stored in your Hard Disk or any other storage media and ready to apply

3. Please verify the data before submission.Once submitted editing of data is not possible

Register Here : https://excise.goa.gov.in/edealer/New_Reg/Menu.aspx

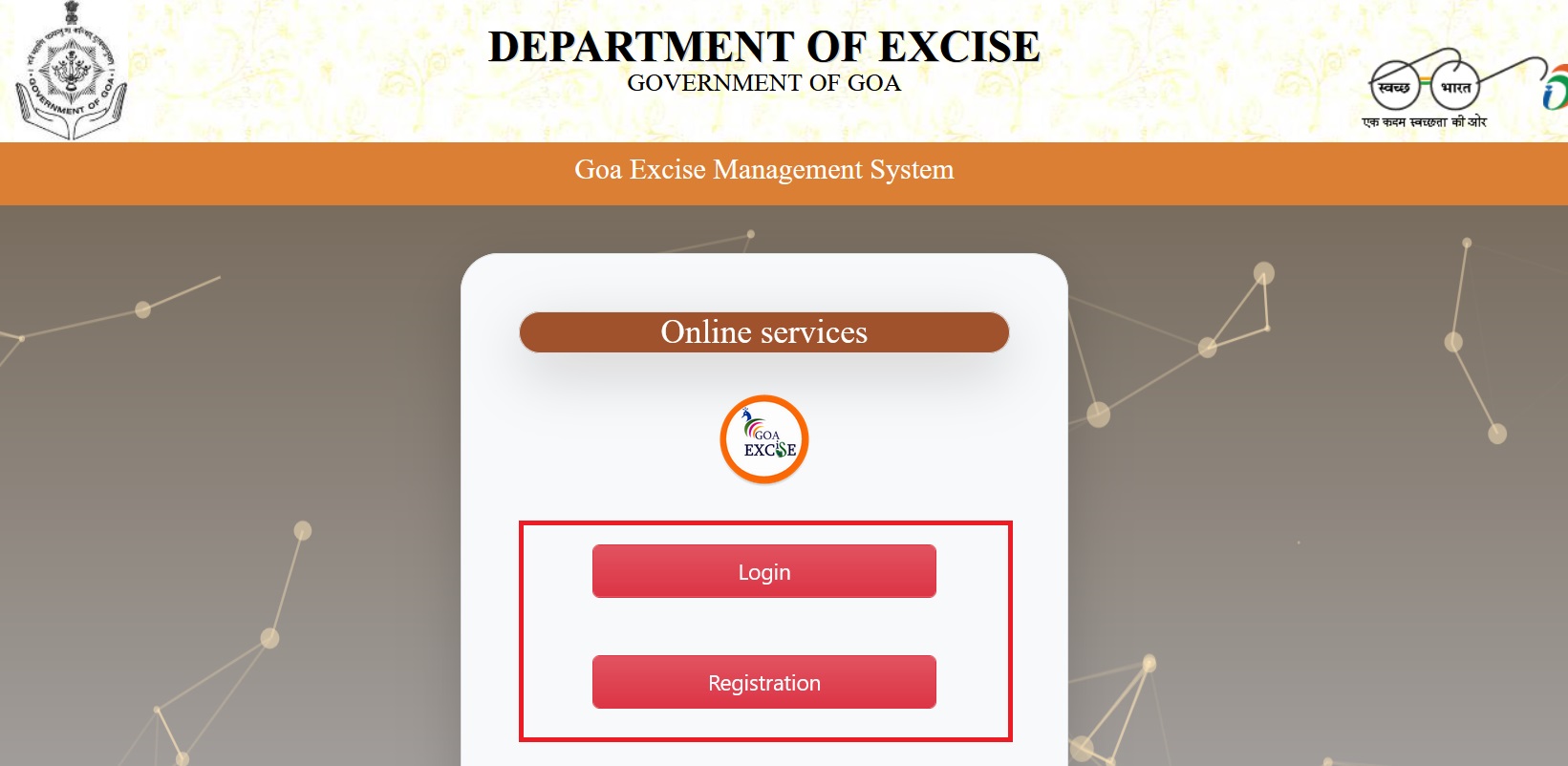

How To Login To Goa Excise Management System (GEMS)?

To login to Goa Excise Management System (GEMS), Follow the below steps

Steps:

Step-1 : Go to the link https://excise.goa.gov.in/edealer/User/UserLoginPage.aspx

Step-2 : Enter your User Name and Password and

Step-3 : Click On Login Button

FAQ On Goa Excise Management System (GEMS)

Frequently Asked Questions FAQ On Goa Excise Management System (GEMS)

Who can avail facilities of e-services?

All registered dealers who have valid EIN number can avail facilities of e-services.

What are the major e-services available through GEMS?

Application for new NOC/Permit ,Extension of NOC/Permit, Cancellation of NOC/Permit, Renewal of Licence, Label Registration, Renewal of Label, Label Transfer, Take on Record.

Can dealers get the online services without visiting the department?

Dealer has to visit the department only one time to collect the NOC/Permit/Letter/etc.

Can new dealer registration be done online?

No, there is no online provision for new registration. However the same can be provided in near future.

Is it safe to access the GEMS portal from cyber Cafe’s?

Yes, but the secrecy of the password should be maintained by the user at all times.