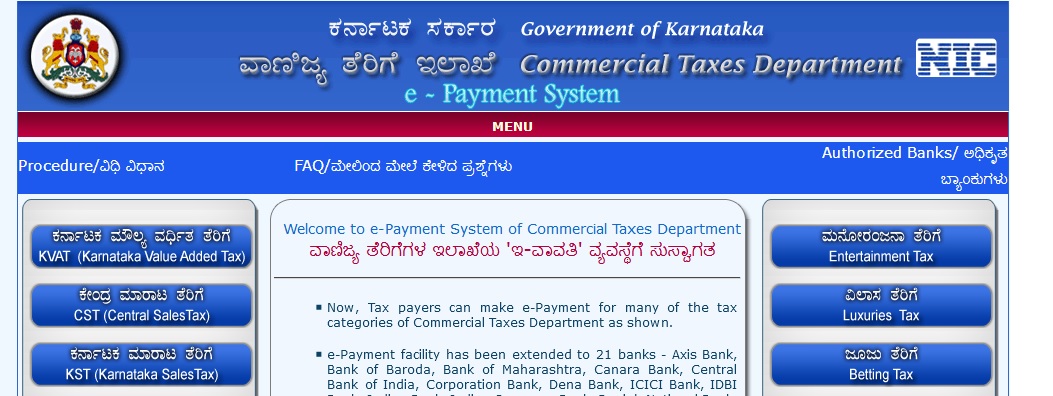

Commercial Taxes Department Karnataka : VAT E-Payment Procedure

Organization : Karnataka Commercial Taxes Department

Facility : E-Payment for Commercial Taxes

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

Home Page :https://vat.kar.nic.in/

Pay here :https://vat.kar.nic.in/epay/

VAT Procedure

E-Payment :

Step 1 :

Under e-payment, Select the type of Tax you want to pay and Click on it.

Related : e-Registration of VAT Karnataka : www.statusin.in/3945.html

Step 2 :

Select whether you are a Registered dealer, Unregistered dealer or New. If you are a Registered dealer, enter your TIN/RC number. On entering of TIN/RC, your name and address and LVO Office code will be displayed automatically. If you are Unregistered dealer, you must enter your Name / Company Name, Address and select the office code.

Step 3 :

Select the payment type you would like to make for eg. Monthly, Quarterly or On Department Demand. If Monthly, then , enter the Year and select the month. If Quarterly, select the year and Quarter. If On department demand, then enter Order no., Order date and Designation.

Step 4 :

Enter the tax details such as tax amount, interest amount and penalty amount. If there is no amount to be entered, then, enter 0 (zero).

Step 5 :

Now select the bank through which you want to make the e-payment. Click on Next, the screen will display the details of the transaction that has been entered. Now click on Submit. You will see a unique Commercial Tax Reference number (CTD Ref. No.) that is generated. Note this number for future use.

Step 6 :

Now click on ‘Click here for Payment’. You will be directed to the net-banking website provided by your bank. All the details entered in Step 1 to Step 5 will be automatically passed to the net-banking website. Enter your login and password and confirm the transaction. The net-banking website will display the e-payment slip with all the details. The bank e-payment slip can be printed or saved to a file for future reference. The net-banking website has a link to return to Commercial Tax website. On clicking of this link, you will be directed back to Commercial Tax website.

Step 7 :

On returning, the payment details are automatically updated to the CTD website. Sometimes, the internet may get disconnected after making the payment in the bank website. In such cases, you can use the Verify option to update the payment details on the CTD website.

Payment details of corporate accounts will be passed as ‘Partial’ after the confirmation in the net-banking website. The Verification for corporate accounts will have to be done after one day to know the exact status.

Verify :

Step 1 :

On clicking of this option, a screen is prompted to enter CTD Ref.No or TIN/RC number. The date of making payment and the amount is mandatory.

Step 2 :

Now click on Submit. All the transactions that have been entered for the requested particulars are listed.

Step 3 :

Now click on Verify. The payment details that have been made for the selected transaction are displayed and updated on the CTD website.

Step 4 :

If the payment made is successful for the Retail account, then the transaction is Verified else the transaction is not Verified. If the transaction is not verified, firstly, check in your net- banking website, if the amount is credited. If the amount is credited and your account is Retail account, then you can try once more to Verify. If still not Verified, you can check after 1 day. If your transaction is still not verified, then you can contact the CTD Helpline. For corporate accounts, on confirmation of payment in bank website, the amount is not credited immediately. Only on approval by the bank official, the amount is credited. You can check your account if the amount is credited. If so, you can try the Verification process from the CTD website to update the status.

Step 5 :

If any problem in encountered in the net-banking website, such as amount is credited more than once/ not able to login/ password is forgotten/incorrect balance, then contact the Bank Helpline.

E-Challan :

Step 1 : On clicking of this option, a screen is prompted to enter CTD Ref.No. or TIN number. The date of making payment and the amount is mandatory. All the transactions which are verified successfully, will be listed. Select the transaction from the list. The Challan is displayed. Click on Print to print the e-Challan.

I have zero sales but I get an “Invalid amount” message when trying to file e-payment. Should I file a return or not?

214752908

Is this challan generated?

What number is this? and what is your payment date? It is also required to print your challan.