mypolicy.sbilife.co.in Online Customer Self Service : SBI Life Insurance Co Ltd

Name of the Organisation : SBI Life Insurance Co Ltd

Type of Facility : Online Customer Self Service

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

Home Page :https://www.sbilife.co.in/

FAQ : FAQ for Online Customer Self Service

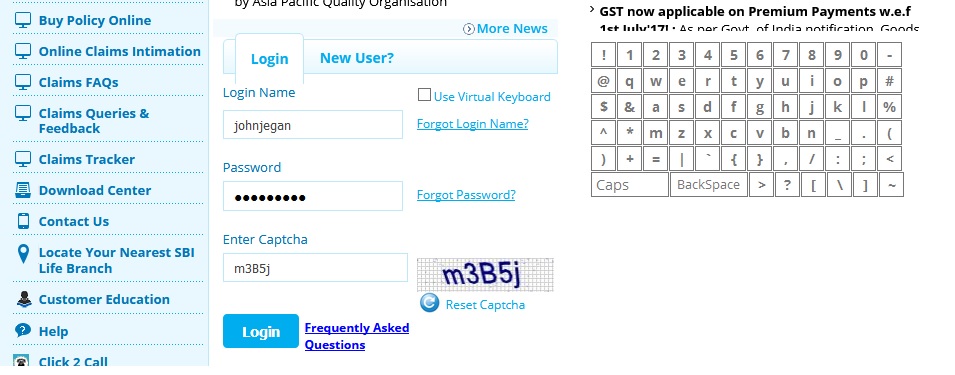

SBI Life Insurance Customer Self Service

To provide our esteemed customers an enhanced experience, our “Online Customer Self Service” initiative has been launched. This would enable you to create your account, enroll and view your policy details and request various services related to your policy. You can now enjoy our service at your convenience. Mention your policy number on the renewal premium cheque

Related : SBI Life Insurance Register For E-Statements : www.statusin.in/10035.html

ALERT CUSTOMER – SECURE CUSTOMER :

Life Insurance Fraud is a multi-billion-dollar problem nationwide. Watch out for these common scams : These BOGUS CALLS posing as insurance agents promise you a lot of things and ask for your Account Number and other personal information. After giving you a bogus quote, or promising to get back to you, these scammers have enough to steal your identity.

Proof :

Never pay for a premium in cash We don’t accept Cash for Renewal Premium except at APOnline franchisee for premiums up to Rs. 49,999/-

Pay by Cheque :

** Always cross your cheque made out to the insurance company directly and not to individual agent or broker. In addition always request a receipt.

Necessary update to be informed in writing :

Update such as change in address, contact details, nominee change can be sent in writing to the below address for better customer service. Now Online Renewal Premium payment of a policy is possible for lapsed policies also up to 5 months and 25 days from the due date. Please pay renewal premium of your policy within grace period only, it is in your interest.

However Premium for SMART PERFORMER (44), UNIT PLUS SUPER (49), SARAL MAHA ANAND (50), SMART SCHOLAR (51), SMART HORIZON (52), & SMART ELITE (53) is allowed up to 71st and 86th days from the due date for monthly and non monthly frequencies respectively.

FAQ On SBI Life Insurance MyPolicy

1. What is my Customer ID?

Please refer the policy document to know your customer ID/No.

2. Does one need to create separate MyPolicy account for each of the policy?

No, if the customer ID is same you can enrol policy under one login name. Customer ID is the same for policies belonging to the same life assured.

3. If getting error “Invalid policy number”?

Please enter the alphabet in capital letter for policy number having alphabet.

4. What should be done for the error “This Policy has been already registered”?

It means your other policy with the same customer ID has been registered under MyPolicy. Please try login with that particular login details and enroll the policy by following the mentioned path: MyPolicy >> Enroll policy

5. Forgot Login name?

To recover login name : Kindly click on “Forgot login name”. Enter policy number > Date of Birth> Select hint questions or Customer id.You would receive the Login Name on the Registered Email ID

6. Forgot password?

To reset password again: Click on “Forgot password”. Enter Log in name, customer ID or Hint question & answer You would receive the Reset Password link on your registered Email ID

7. Is the captcha is confusing?

If the captcha is confusing you can click on reset captcha to get an alternate captcha image and use the same to login, one can reset the Captcha any number of times.

8. I have not received premium receipt. When I will get final receipt from the Company?

In case of Non-ULIP Policies, it will be dispatched to you after three working days. In case of ULIP policies, the receipt will be dispatched after three days from the date of allocation of premium.

Features of SBI Life Insurance

Sure. Here are some of the features of SBI Life Insurance Classic Plan:

** Guaranteed Sum Assured: The policyholder will receive a guaranteed sum assured on maturity, regardless of the investment performance of the underlying funds.

** Flexible premium payment options: The policyholder can choose to pay premiums annually, semi-annually, quarterly, or monthly.

** Tax benefits: The policyholder can avail of tax benefits under Section 80C of the Income Tax Act, 1961.

** Guaranteed returns: The policyholder is guaranteed a minimum return of 4% per annum on the premiums paid.

** Death benefit: In the event of the policyholder’s death, the nominee will receive the full sum assured, along with any accumulated bonuses.

** Critical illness benefit: The policyholder can avail of a critical illness benefit, which will provide a lump sum payment in the event of a covered critical illness.

** Return of premium benefit: If the policyholder survives the entire policy term, they will receive a return of all the premiums paid, along with any accumulated bonuses.

Send e statement to my mail ID

My policy no is 30010726206 and customer ID is 16248274. I am not being registered for e-statements.

How to know sbi fund value through online, or missed call?. like getting in uti, icici.

I Have Not Received my Premium Receipt.

SEND E-STATEMENT ON E-MAIL