Bajaj Finance Credit Card Application Status : bajajfinserv.in

Organisation : Bajaj Finance Limited

Service Name : Track Credit Card Application Status

Website : https://www.bajajfinserv.in/credit-card-application-tracking

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

How To Check Bajaj Finserv Credit Card Application Status?

In partnership with RBL Bank, Bajaj Finserv brings you different variants of SuperCards to make purchases and bill payments easier. With the power of 4 cards in 1, the credit card comes with a simplified application and tracking facility.

Related / Similar Facilities:

Bajaj Finserv Bill Payment App

All you need is to follow the step- wise procedure to check the status of your credit card application. Proceed to track your credit card status online with a one-click mobile verification.

Bajaj Finserv also enables applicants to check the status offline with considerable ease.

Track Online

Follow these steps to complete the status check for your credit card application.

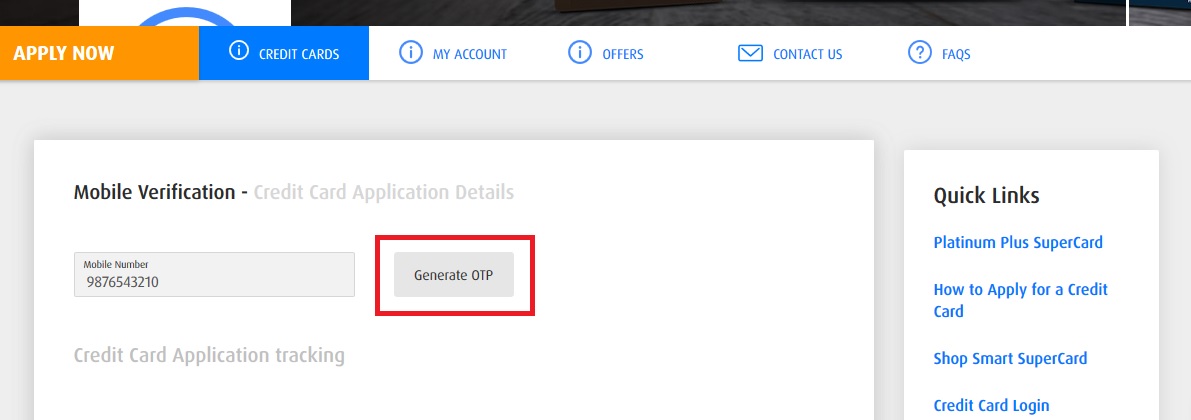

Step-1 : Open the dedicated page for Bajaj Finserv RBL Bank SuperCard application status.

Step-2 : Provide either of the required details on the page

** Mobile number.

** Email ID.

** Customer ID.

** Reference number.

** PAN number.

Step-3 : Check the application status for your credit card instantly displayed on the screen. When you choose to enter the mobile number, verify it with OTP.

Track Offline

To check the application status of your RBL Bank SuperCard, opt for one of the two methods given below.

** Give a missed call to 9289222032. Receive a call from our representative to know your application status.

** Reach out to us at your nearest Bajaj Finserv branch and know your credit card status.

What is Credit Card?

A credit card is a plastic card issued by financial institutions, which lets you to borrow funds from a pre-approved limit to pay for your purchases. The limit is decided by the institution issuing the card based on your credit score and history.

Generally, higher the score and better the history, higher is the limit. The key difference between a credit card and debit card is that when you swipe a debit card, the money gets deducted from your bank account; whereas, in case of a credit card, the money is taken from your pre-approved limit.

Users can swipe the credit card to make a payment or use it for online transactions. After you apply for a credit card, simply make sure that the borrowed amount is repaid within the stipulated time frame to avoid penalty charges. Your credit card details are always secured with the card issuer and you should not share your credit card information with anyone to avoid fraud.

Bajaj Finserv offers different types of credit card to suit your diverse needs. Moreover, the Bajaj Finserv credit card has great offers and benefits to make shopping a rewarding experience for you.

Contact

Our customer service is available 24×7 and you can contact us any time by calling the RBL Bank helpline number 022 – 70090900. Or, you can write and send your concern, queries or any feedback at supercardservice@rblbank.com.

i am teackink for emi card